Refineries of the future: critical decisions post-COVID

Market volatility & regulatory requirements require organisational streamlining and decisive strategic and operational action.

Refineries that are able to respond to changes in market conditions maximise their swing yields, and route less valuable streams to higher margin process units will be in a better position going forward.

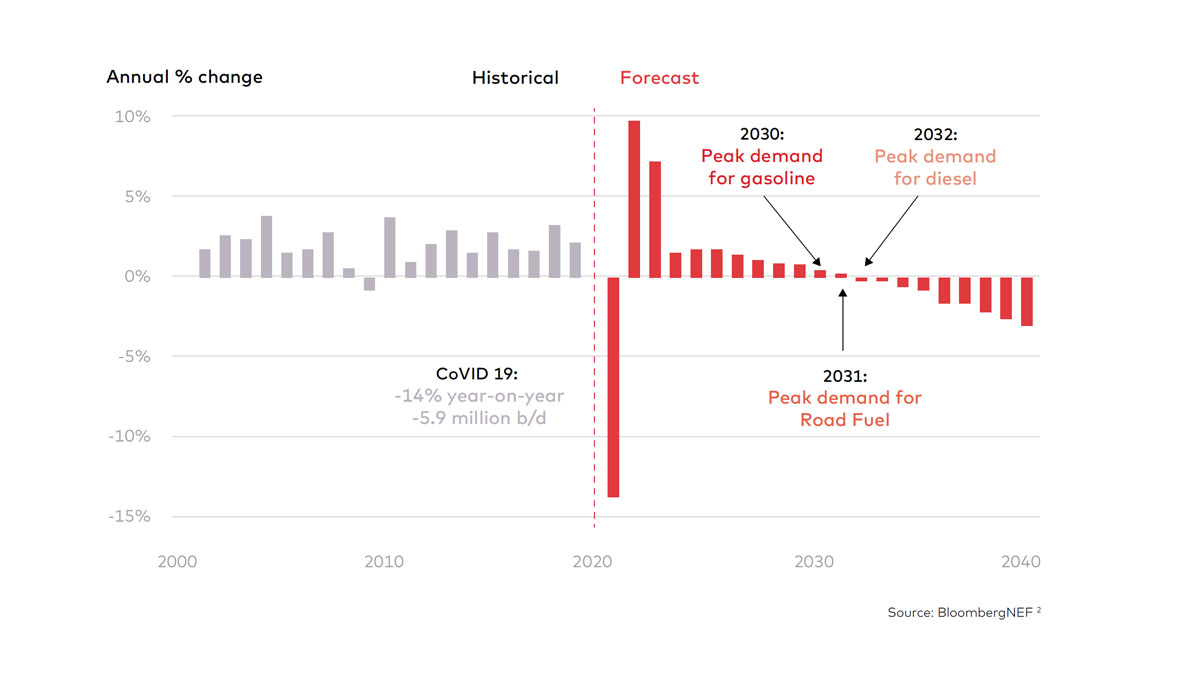

Entering 2020, the outlook for the GCC NOC downstream oil and gas industry was one of the strong margins and robust demand. Companies were building for a future of plenty, retooling their refining and transport capacities, and entering adjacent industries. The global COVID-19 pandemic caught the industry unprepared. Demand for aviation fuel fell by almost 50% in 2020 on the previous year, while road transportation fuel consumption dropped by approx. 10%1 (see Figure 1). Inventory levels increased forcing refineries to slow down, shut down certain assets, and favor more commercially viable operating modes, e.g., maximizing lighter distillates versus gasoline in catalytic cracking units.

Accordingly, the way forward for refiners is to diversify the value chain via petrochemical production. This will enable higher returns in the near-term and improved flexibility to meet market demand for petrochemical products over the longer term.

Figure 1: Development in Global Road Fuel Demand

- OPEC World Energy Outlook 2045: https://woo.opec.org/

- about.bnef.com/blog/oil-demand-from-road-transport-covid-19-and-beyond/

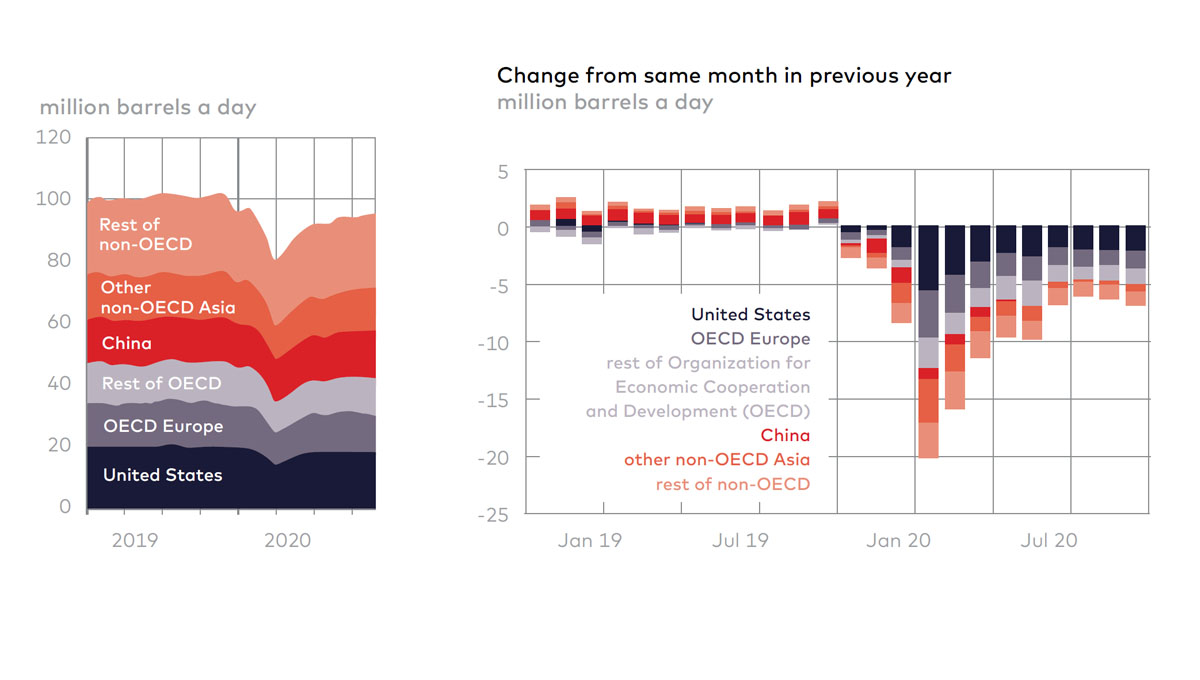

Figure 2: Monthly world liquid fuels consumption (Jan 2019 - Dec 2020)

Source: US Energy Information Administration, Short-Term Energy Outlook supplement, Developments in Global Consumption, January 2021 3

Looking ahead

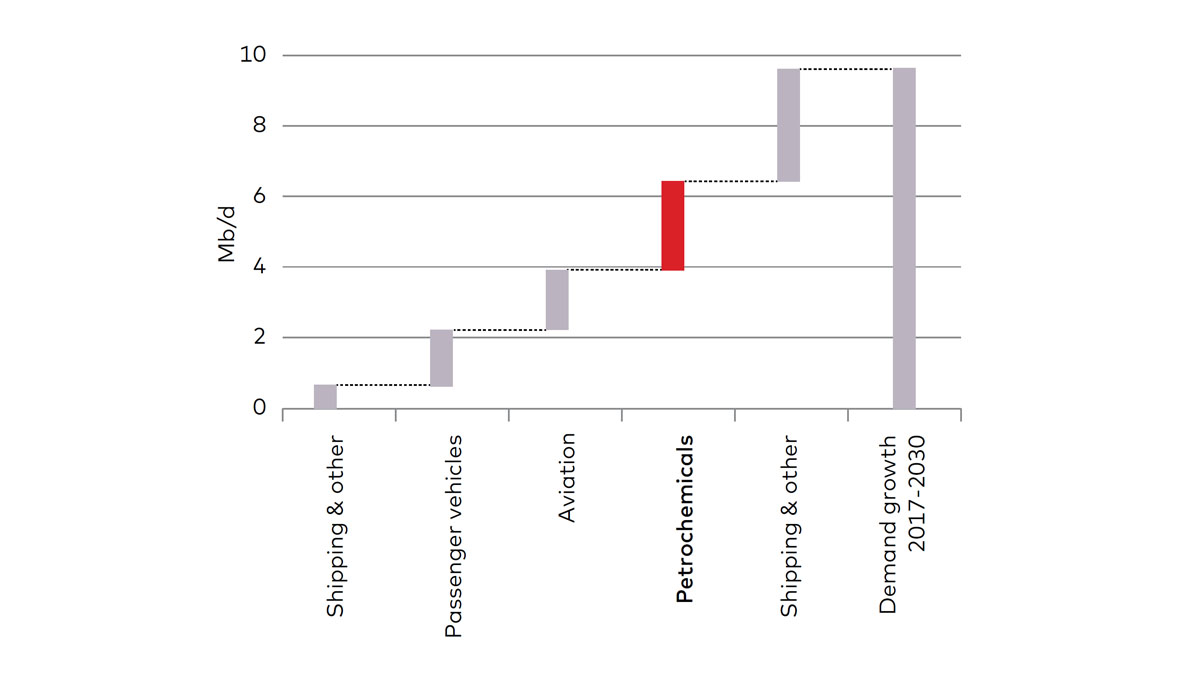

However, research suggests that demand for petrochemical-based products is likely to grow significantly over the next 10-30 years, with the International Energy Agency predicting that petrochemicals are likely to account for “over a third of the growth in oil demand to 2030, and nearly half to 2050, ahead of trucks, aviation and shipping”4 (see figure 3). Accordingly, the way forward for refiners is to diversify the value chain via petrochemical production. This will enable higher returns in the near-term and improved flexibility to meet market demand for petrochemical products over the longer term.

While a shift in demand is shaping the future of the refining industry, so is regulation. Regulatory policies on emissions control have become stricter at a global level and will only become more exacting over time. Energy companies also have to work toward regional initiatives such as Saudi Arabia’s Vision 2030, the UAE’s Vision 2021 and China’s new five-year plan. At the same time, lower (and even negative) margin contributions at the refinery level for products are forcing executives to reassess performance optimization and the prioritization of investments. In order to address all these pressures and remain profitable, energy companies need to consider carefully how they structure themselves and examine what changes will allow them to best position themselves for the future.

- https://www.eia.gov/todayinenergy/detail.php?id=46596

- IEA (2018), The Future of Petrochemicals, IEA, Paris https://www.iea.org/reports/the-future-of-petrochemicals. All rights reserved.

What needs to change

Energy companies will have to transform radically. Large facilities with historical inflexibility will need to become more efficient processing operations to make better use of economies of scale, keep tighter control of administrative costs, and seize the opportunities for margin improvement through digitizing. Refining operations are complex and process variability is linked to many factors ranging from the quality of the feedstock to asset integrity and reliability. Many refining operations do not have a clear understanding of what their true gap to potential really is. Relying on historical trends and “averaging out” performance ends up “hiding” opportunities that will help them achieve operational excellence.

We believe there are two key changes the industry will need to make: strategic reforms and operational performance enhancements in a number of areas.

With one in five oil refineries expected to cease operations over the next five years, choosing the right operating model and level of integration will be crucial for survival and sustained profitability in a volatile market.

Strategic reforms

Operating models for refiners – A diverse palette

Four principal operating models are currently in play in the industry, with no single model dominating. Summarized briefly, they are:

- Upstream integration.

A single source of crude oil accounts for more than 50 per cent of the upstream integrated refiner’s supply; the crude source can be either equity crude or a long-term contractual arrangement. - Merchant refiner.

Lacking both upstream and downstream integration, the merchant refiner has the flexibility to react quickly to both crude and downstream supply opportunities and to adjust operations or integrate into a larger logistics hub. - Downstream integration.

Dedicated marketing channels take more than 50 per cent of the downstream integrated refiner’s production in trades secured either through equity or long-term contractual arrangements. - Vertical integration.

Fulfilling the requirements for upstream and downstream integrated refiners at the same time, the vertically integrated refiner is able to capture value by making the most of advantages across the value chain.

In the face of rapid change, refiners need to re-examine what really creates value for them. In such a diverse landscape, it is clear there can be no one-size-fits-all approach to business.

Digitization - advanced analytics and machine learning

Several areas up and down the value chain are ripe for digital transformation. We have seen terminal-level pricing engines for products help capture margin by understanding local market dynamics, including price elasticity. Digitizing operations has lifted refinery yields and throughputs. The use of new software in scheduling and within a supply chain has enhanced maintenance execution, boosted labour productivity, and reduced cost. In transportation, digitization has streamlined the movement of crude and products to and from refineries by determining the timing and optimizing the mode of transport (from pipeline to truck, rail, or ship). The key to effective digitization is the choice of the right system to suit the needs, and the integration of all digital solutions to produce meaningful data.

Large facilities with historical inflexibility will need to become more efficient in processing operations

Re-evaluating portfolio strategies

As transformation illuminates the intrinsic value of assets, a clear vision for both five- to seven-year strategies and longer-term plans combined with the accompanying investment controls are key to guiding the company’s future. They should form the basis for identifying and seizing growth and value creation opportunities in the short and long run.

Operational Performance Enhancements

Preserve cash

Companies will need to preserve cash until the market improves. They should exercise the full set of cash-management levers, including reducing inventory positions, lengthening suppliers’ payment terms, reducing receivables terms, deferring capital expenditures, and halting equity disbursements. Many have already begun to react, reducing headcount, operating and capital expenditure. Such incremental changes are a start. To emerge from these challenging times with the capability of delivering another decade of long-term growth, companies will have to go much further. Examples of options include but are not limited to the following.

- Streamline the supply chain to reduce costs while ensuring the solvency of critical suppliers. That could include consolidating vendors, renegotiating prices based on volume, “should cost” analysis, establishing long-term supply contracts, and reevaluating the total cost of ownership of equipment. Strong players will find opportunities to capture long-term value by taking equity positions or negotiating favourable contracts with distressed suppliers, particularly in the areas of capital equipment and consumables.

- Protect crude and product-transportation relationships including pipeline-shipping history and third-party tank positions, capturing long-term value when infrastructure is choking on crude and products. Actions range from awarding line space based on the pre-COVID shipping history to reinstating “open season” bidding. Initiatives could include guaranteeing favourable logistics and creating value through joint ventures and partnerships. Taking an equity stake in a strategic pipeline, for example, not only helps the supplier but also creates lasting value for those players smart enough to spot the opportunity. However, as the industry does not always decide its own fate, anticipating the actions of regulators is also critical.

- Adjust crude and product-trading strategies to account for changing market dynamics. Long-term reductions in jet fuel demand, for example, would change the relative value of different crudes and constrain logistics for refiners. Market volatility will challenge organizational strategies, so reexamine the role of trading operations. Ask questions such as, “Under the changed circumstances, should the trading desk aggressively try to create value or act more conservatively to serve as a feedstock-procurement or product marketing function?”

- Reduce general administration costs, for example by using industry benchmarks that account for the possibility of continued depressed demand for gasoline, diesel, and jet fuel. Such benchmarks could include measuring the ratio of G&A costs to revenue. Stop unnecessary work and streamline or automate remaining processes such as purchasing or outsource activities such as payroll administration. Given that industry players have spent a decade positioning themselves for a growth market, we see the potential for a 20 - 30 per cent reduction in G&A costs on pre- 2020 levels.

Optimize operations

Launch operations improvements by truly understanding the gap to potential and unlock the full slate of management opportunities in operations and expenditures. This includes understanding all unplanned downtime, alignment with the Sales & Operations team to focus on the right product mix, and finding ways to increase throughput and energy efficiency.

- Improve reliability and reduce maintenance costs by adjusting the way equipment is operated and managed, e.g., by measuring the contributions that certain equipment makes to overall profitability, safety, and environmental footprint. To identify the best course of action, ask questions such as, “How would the failure of our hydrogen system compressor affect processing capacity, emissions, and repair budget?”

- Examine utilities efficiency. How well is the energy used to operate the refinery? The efficiency of water used to regulate temperatures in the refinery, is particularly critical because it is almost always scarce.

- Adjust maintenance routines for specific pieces of equipment to ensure correct cost-to-performance trade-offs. For example, assess whether failing equipment should be replaced or could be operated differently to extend its life. Once new operating conditions are established, more cost-effective maintenance schedules can safely be introduced. Options include taking a critical look at how often spares are switched and when new thresholds for vibration or process conditions are established.

- Create value through precision. Limit how often a product exceeds its minimum quality requirements by improving product demand forecasting, blending processes, or using in-line-measurement tools. Players with optimized operations planning spend less on the components that make up their finished products, from gasoline to asphalt.

- Continually improve modelling to understand how each raw material affects operations. That allows refiners to make better selections, reduce energy consumption and free up working capital through improved production planning. The potential gain is worth the work. When calculating refineries’ material balance closure, poor performers find they cannot account for as much as 5 per cent of their throughput. That contributes to sub-optimised operations and ill-informed commercial decisions.

- Reduce technical-support ratios, such as the number of engineers per operating unit, or total engineering spend. There are several ways to do this. Focus on the highest-value activities, review when and how to use third-party contractors, cross-train employees so that they can perform multiple tasks, and reconsider overtime practices. One plant reduced its project engineering- labour expenses by 25 per cent by changing the way it allocated technical support.

- Reimagine functional-support delivery. Introduce zero-based approaches or test the use of more agile support models. Such actions are particularly valuable for multi-refinery companies in which resource pooling can be a strong lever. In a cost-focused environment, a shift back

- Revamp planning processes. Amid ongoing price volatility, it is particularly important to limit shortsighted investments by improving forecasting and planning. Focus on reducing the risk of overinvesting during peaks and illiquidity during troughs in future market cycles.

Players with optimised operations planning spend less on the components that make up their finished products, from gasoline to asphalt.

To uncover another decade of value growth for shareholders, downstream companies will have to radically transform and will need to optimize their operations to cope with a highly demanding regulatory and market environment. Those that succeed will shape the industry’s future.

Conclusion

The pressure from governments, investors, and boards of directors for refineries to develop business plan scenarios in case demand for their products continues to be negatively affected is ongoing. Refineries that are able to respond to changes in market conditions, maximise their swing yields, and route less valuable streams to higher margin process units will be in a better position going forward. However, it is not enough to focus on market (external) factors as they require large injections of capital and usually take years to translate into real benefits. A strong performance-based operation that ensures the stability of critical equipment and addresses bottlenecks will help improve results. Being able to pinpoint the reasons for the ‘losses’ in performance, whether this is at critical equipment level, or by establishing targets and comparing energy usage vs baselines will continue to drive excellence in operations and further improve margins.

dss+ often uncovers underperformance and supports refiners to unlock “hidden factory” potential, frequently saving refineries millions of dollars a day in lost production. This journey aims at developing the capabilities of our clients to work smarter, monitor performance, and make data-driven decisions.

In the decade leading up to the demand shock unleashed by the COVID-19 crisis, the downstream oil and gas industry was making the best of a good situation. Refiners capitalised on the twin benefits of abundant, relatively cheap supply and increased demand for their products. Companies shifted their focus from controlling costs to capturing opportunities for growth.

Today, those same companies face a very different world. The global pandemic has fundamentally changed the market. Players no longer exhibit the resiliency they mustered during prior oil shocks. To uncover another decade of value growth for shareholders, downstream companies will have to radically transform and will need to optimize their operations to cope with a highly demanding regulatory and market environment. Those that succeed will shape the industry’s future; those that fail will become consolidation targets.