Accelerating ESG Impact in Mining

The mining industry is well aware of the need to improve its environmental, social and governance (ESG) performance and reputation. How it does so and the speed at which it demonstrates change are what will make the rapid ESG transformers stand out to investors and communities alike. With pressure and scrutiny from stakeholders only set to increase, how can mining companies integrate ESG into their operating model, scale up change, improve ESG governance, and measure as well as communicate impact?

Shifting from Strategy to Implementation

Introduction

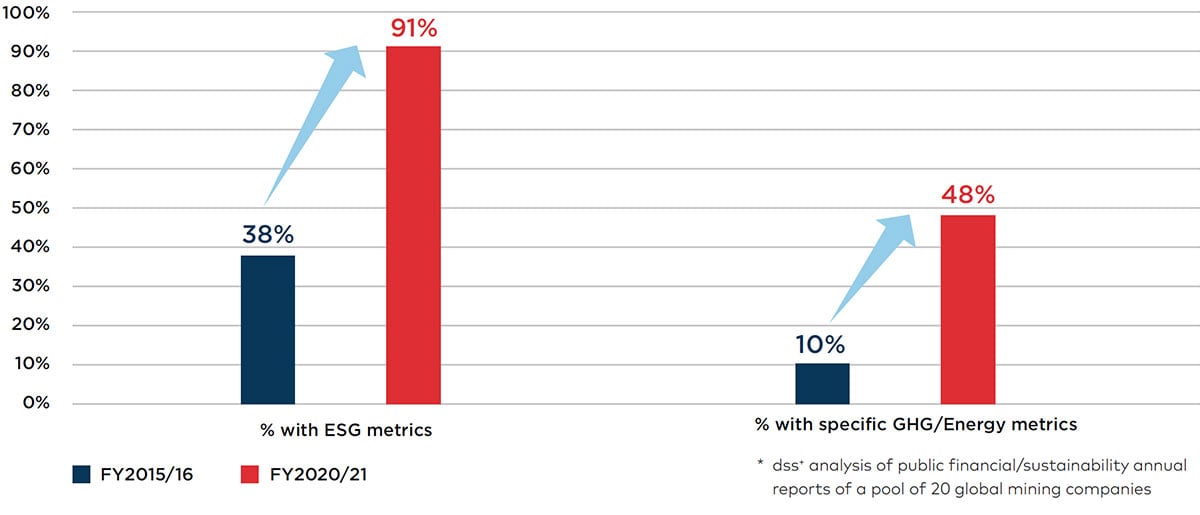

As the focus on climate change intensifies, numerous mining companies have set ambitious corporate sustainability goals and several aim to reach net-zero emissions before 2050. But how quickly they get there and the steepness of the trajectory they follow in their pursuit of ESG goals will have a large effect on their impact. With recent environmental and social catastrophes fresh in their minds, mining companies are aiming for accelerated and more visible change. Not only have several companies appointed new board members with extensive ESG and sustainability experience, but metals & mining companies are also increasingly linking remuneration for senior executives to measurable ESG improvements. A steep rise in the percentage of executives whose remuneration is partially based on ESG metrics is apparent today compared to five years ago, as shown in Figure 1. At the same time, we can observe that the decarbonization ambitions of mining companies is not yet fully reflected in specific GHG emissions incentives for executives, with less than 50% of sample miners having made a clear step forward.

Despite this effort to drive ESG performance from the top, the UNEP’s report on Sustainability Reporting in the Mining Sector1 still highlights "the lack of a global common vision for the sector in terms of what constitutes sustainable operations for mining, including Key Performance Indicators at the mine-site level." It further criticizes most large mining groups for not moving reporting "from the global corporate level to a more granular, minesite level". And according to the Responsible Mining Index2, effectiveness of environmental responsibility lags about 50 per cent behind stated commitment. Moreover, recent "greenwashing" scandals will further increase the level of scrutiny and demand for more standardized, detailed, and transparent reporting requirements of actual ESG performance and impact. So how can mines move from ESG strategies to effective implementation while communicating measurable ESG impact in greater detail?

"ESG has been central to our thinking and strategy since 2003. It is not new, but pressure on financial institutions is starting to reflect on us. It actually feels a little delayed. We had expected it to come way earlier."

– VP, precious metals company

Figure 1: ESG metrics integration into mining executive remuneration – Variation between 2015/16 and 2020/21

ESG impact expectations on the rise

ESG is now seen as one of the biggest challenges and opportunities facing the mining sector. It is however not new to the industry which has dealt with numerous ESG aspects for a long time. What has changed is the heightened expectations and greater involvement of the financial community, creating opportunities for proactive metals and mining companies to distinguish themselves by generating value sustainably and minimizing business risks.

In this context, we have been witnessing a shift from a focus on ESG compliance and reporting to bolder commitments with measurable targets as well as greater transparency in reporting progress. Organizations are changing from viewing ESG as a functional necessity to a way of doing business, for example by setting clearer direction and progressively re-aligning decisionmaking and capital allocation with new aspirations.

The importance of achieving and demonstrating impact in ESG performance affects all fields, not only the ability to attract capital or projects. With the more nuanced diversification of financial instruments, bank loans may, for example, be tied to emission reduction levels. Companies without a compelling and systematic approach to addressing material ESG gaps, or those who are unable to show actual impact on critical ESG aspects are finding that it is more difficult to secure funding, obtaining permits or insurance coverage, attract talent, and maintain their social license to operate.

"First tier organizations will think about and incorporate ESG, second tier won’t get investments. Not doing ESG well will mean insurance will be a challenge and it will be a barrier to entry on stock exchanges."

– Non-Executive Director, leading iron ore company

In this context, it is no longer enough to set long term ambitious goals and disclose a wide array of metrics. What will convince investors and other stakeholders are clear plans and systems of measurement that drill down to mine-site level and demonstrate actual impact. That is not an easy task considering the wide range of aspects that play into ESG, but it makes it ever more important to define and implement the right approach toward the goals, ensure timely progress and impact as well as build resilience to be able to adapt to ever changing expectations, scenarios, and regulations.