Ensuring Supply Chain reliability during disruptive crises

The COVID-19 pandemic has thrown the world economy, and its operations and supply chain systems in particular, into an unprecedented crisis. So much so that Governments across the world had to impose lockdowns of various degrees in their countries, halting or slowing down most economies. The resultant significant disruption to supply chain systems in India has raised questions on the reliability of supply chains and their susceptibility to such large scale disruptions. This insight reflects on how Indian businesses can implement short term actions to strengthen the supply chain as well as prepare well into the future to sustain a reliable and resilient supply chain system.

In today's ever-changing world, the long and complex supply chains have been subject to disruption, be it on account of a trade war between two large economies, natural/man-made disasters, or the spread of diseases which have adversely affected almost all economies. These shocks have disrupted both supply and demand; resulting in decreased production and consumption.

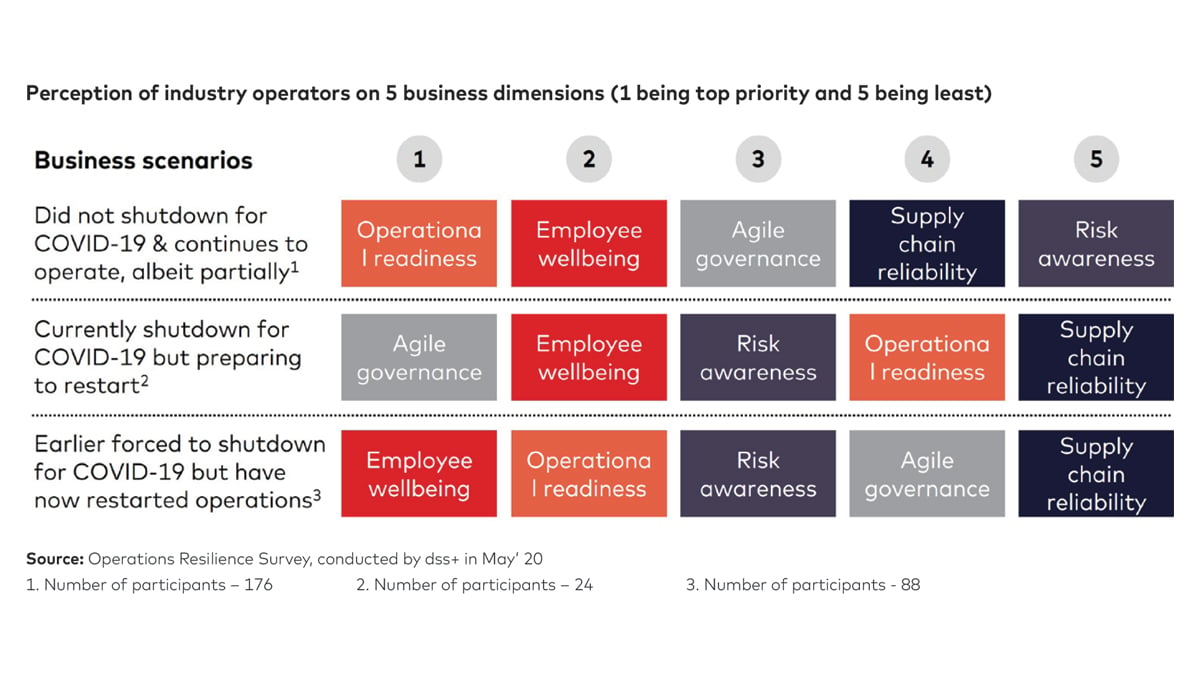

In an operations resilience survey conducted by dss+ in India, participants highlighted supply chain reliability as the dimension in which they were least prepared when restarting operations following a crisis. In the context of COVID-19, the key segments of Indian manufacturing, transport services, non-essential manufacturing and e-commerce were suspended and had to stop operations resulting in a cascaded stoppage in the entire value chain.

For instance, major auto manufacturers in the country had to shut down their operations resulting in a breakdown in the value chain. All ancillaries supporting Original Equipment Manufacturers (OEMs) had to stop production, affecting livelihoods depending on the entire eco-system of auto manufacturing. The situation is far worse for small and medium enterprises which are labour intensive and mostly operate with high working capital.

While the country's lockdown and quarantine are slowly beginning to lift, and as the Government is allowing more industries to operate, Indian businesses will be working alongside COVID-19 risks, by building capability to manage challenges across the entire value chain of the organisation. According to interviews conducted by dss+, most industry leaders expect the best case revival of their businesses by Q2 of 2021. We all hope for a safe start-up of businesses, but the world post lockdown will not be the same as before. If indications from March'20 IIP (Index of Industrial Production) are considered, there will be a significant drop in productivity and industrial output in the near term and beyond, challenging all growth plans.

Industry views on the impact of disruptions on the supply chain

Based on dss+ interactions with industry leaders, we found that the approach toward risk management in the supply chain varies a lot from company to company. Key priorities emerging out of such interactions are: to ensure the health and safety of personnel, conserve cash, minimise non-essential spending, create transparency across the supply chain, and use digital tools to support decision-making.

Oil and Gas: The oil and gas sector has been a troubled industry, seesawing between multiple demand and supply cycles, and is now hit hard by the COVID-19 crisis. Although organizations are working on preserving cash, deferring or cutting down on discretionary capital and operating expenditures, they are at the same time looking to navigate the current crisis and become more agile. Some of the initiatives which upstream oil & gas players are adopting include:

- Identify opportunities to re-negotiate long-term contracts with service providers, while at the same time they acknowledging deep strategic integration with the service providers will be beneficial for both of them.

- Embrace digital technologies for materials and spare parts management, especially for long lead time items which take a lot of time and effort of procurement and supply chain functions.

- Use of 3D technologies can become the new norm for the production of small spare parts, non-critical items and safety gloves, reducing dependencies on suppliers.

- Optimize operating costs by 20-30%, by reducing overhead, bringing synergy between different cost centres & Joint Ventures and sharing resources.

FMCG: "Without change, there is no innovation" and this has been particularly true for many small and local brands in the FMCG sector. Many small players latched onto the opportunity to increase their production or shift focus to other essential products, from hand sanitisers to ketchup to ready-to-eat snacks, and other daily essentials. While manufacturing has not been much of a problem for FMCG players, the logistics of materials have been an issue, with deliveries passing through various containment colour-coded regions. Often there has been a delay in the sourcing and distribution of goods. Industry experts see shifting trends in FMCG sector, such as:

- Shift in consumer buying pattern; "Move from shops to online buying" and therefore a feeder supply chain that integrates retail e-commerce.

- Uptick in-home consumption products with consumers moving from unorganized players to organized players; with a greater focus on quality and hygiene parameters.

- Improved logistics and mobile-data connectivity set up; rural India to be the new demand centre

Logistics sector: The road logistics sector has been hit hard by the ongoing pandemic, with more than 50% of drivers staying off the roads during lockdown bringing road logistics to a stand-still. A study shows that truck utilization fell to as low as 20% for long and medium-haul journeys, during the months of April and May'20. In the marine ports, a shortage of staff for stevedoring activities has caused a significant impact on the movement of goods into and out of the ports.

Experts in this sector believe there will be consolidation in the sector with small-time truckers giving way to large players, and tech-based logistics are likely to be the future norm in the industry. The share of road logistics is likely to fall and the railways are likely to gain a higher share in the medium term.

Short-term actions to minimize loss

In the current context, dss+ recommends that organisations focus on five areas to minimise further loss:

1. Inventory:

Estimate the existing inventory across the value chain including "work-in-progress", finished goods, parts with a lower grade or quality issues, stocks in warehouses and distribution centres, and products used as promotional stock and feed. Estimating all inventory across the value chain will help in capacity planning and subsequent ramp-up of production. Deploying digital tools will hasten the exercise and data reliability, which is essential for a reliable supply chain.

2. Market demand and supplier readiness

In order to estimate the input supply requirement, organizations need to assess market demand through multiple channels, beyond conventional channels prevalent prior to the pandemic. Businesses should understand whether the signals they are receiving from the consumer market reflect true demand or if there is an underlying uncertainty in the forecast, or if there is a strategic shift in demand patterns. It is important that industries use all channels - market insights, analytical tools, communication with customers - to determine the actual product demand and prepare a robust sales and operating plan that enhances supply chain reliability.

Similar to understanding market demand, organizations need to assess the readiness of their suppliers for establishing a reliable supply chain. There should be greater transparency and information sharing between the mother plant and its vendors. For example; the sales and operations planning team need to study the bill of material in detail to understand the source of material, location of the supplier, the ability of the supplier to hold inventory, and mode of transport to identify any risk in the delivery of the desired material, and therefore identify risk mitigating actions such as vendor substitution and product variants.

3. Existing plant conditions and labour requirements to operate

A restart of the manufacturing and warehouse facilities, including associated infrastructure, after an extended lockdown of more than 70 days with stalled equipment, necessitates a systematic approach prior to achieving a safe start-up. This approach includes the following essential actions:

- Providing necessary infrastructure and work processes to protect the health and wellbeing of the workforce is a primary requirement.

- Ensure availability of competent workforce and carry out the relevant training and awareness programmes.

- Carry out risk assessments and develop risk management programmes to eliminate risks. The recent incidents of failed re-starts after lockdown clearly emphasise the need for a comprehensive restart plan focused on the safety and reliability of the plants. A careful assessment of the integrity of critical controls, followed by a comprehensive pre-start-up safety review, are minimum prerequisites to achieving a safe start-up.

Assessing the availability of a workforce to run the plants, warehouses and supply chain segments at desired capacity is of utmost importance. Labour shortages are bound to happen in short term, hence organizations need to plan for the shortfall and make adequate arrangements for continual training of the new workforce. Labour-intensive industries are most likely to have a long recovery time compared to automated/semi-automated industries.

4. Transportation and logistics requirements

Organizations should secure the logistics contracts to minimize exposure to potential cost increases and losses due to potential off-time delivery issues. Having long-term partnerships with selected logistics players can be an effective strategy which is built on re-negotiated win-win agreements. The sector is expected to be more organized with large players moving toward Tech-enabled logistics.

5. Communication with stakeholders in the supply chain

Clear communication, both internal and external to the organisation, is critical to ensuring that everyone associated with the restart and subsequent business ramp-up programmes is well informed in order to take the right actions in a timely manner. Critical communications include transparent communication with employees and key partners on the restart plan, understanding and managing customer expectations, and negotiated alignment with service providers in the supply chain.

In addition, organisations should periodically review the status of progress as per the restart plan, and realign priorities to ensure the supply chain responds reliably and consistently to support the business restart and subsequent ramp-up. It is useful to set up a cross-functional empowered task force to review and provide direction to the programme, as well as allocate requisite resources. The use of digital tools for reliable and transparent communication is expected to be adopted by various players in the supply chain.

6. Building a resilient supply chain for the future Building a resilient supply chain starts from understanding the inherent risks associated with the business. To build a reliable and resilient supply chain, organizations need to have a full picture starting from market research, demand plans, product design, component supply and procurement, logistics mode and network, to organizational capability to solve supply chain issues.

The role of digital technology is becoming increasingly important to the reliability of global supply chains. Current and future technological solutions will influence the reliability of supply chains and make them robust enough to be resilient to disruptions. These technologies include:

- Cloud and mobility-based solutions for continual interaction with the supply chain constituents over a digital platform,

- Online digital view of supply chains with risk alerts and workflows to mitigate disruptions, minimise adverse impact on the supply chains and facilitate prompt recovery after any disruption,

- Integrated supply chain performance dashboards, predictive analytics, risk assessments, scenario planning and digital enterprise solutions for managing operations improvement actions,

- Robotic automation of material handling to minimise the dependence upon manual labour,

- Autonomous vehicles to move materials in warehouses and ports, and

- Intelligent automation and decision support systems for supply chain planning, monitoring and optimisation.

Conclusion:

As Albert Einstein once said, "Learn from yesterday, live for today, hope for tomorrow. The important thing is not to stop questioning". By asking relevant questions and acting on priorities, organizations can come out of this crisis better prepared for future disruption. The key is to reflect on the vulnerabilities of the supply chain and implement a cascaded plan for achieving high levels of supply chain reliability and resilience, starting with a pilot implementation and following it with an improved supply chain programme to rapidly scale up across the organisation.

These insights draw on interviews conducted by dss+ with industry leaders on supply chain aspects, as well as practical experience of dss+ in successfully implementing operations excellence programs at various client sites worldwide. These programs have facilitated the business mission to protect its personnel and assets, preserve the environment, realize operational efficiencies and maximise shareholder value safely throughout the business lifecycle.