Using Strategic Sourcing to Improve Business Continuity and Sustainability

With most parts of the world in varying degrees of lockdown and the movement of goods and people remaining limited, the operating models of most companies have experienced extreme strain. Shocks to supply and demand as a result of extreme market volatility have threatened business continuity, introduced new risks, and added further inefficiencies to operations culminating in increased costs.

Indeed, 44% of executives attending a recent executive dss+ webinar indicated that achieving continuity and sustainability of their operations is now their top priority. This was followed by the need to reduce costs (27%) and improve operational efficiency (19%). Focusing on these three priorities highlights the desire by organisations to drive sustainable improvements to their business beyond ad-hoc cost savings and quick wins.

One tool organisations can use to achieve such longer-term objectives is to adopt a Strategic Sourcing approach. Strategic Sourcing acts as a highly customised and effective lever for organisations to minimize supply chain risk by securing goods & services and optimising spending. By adopting such a true Total Cost of Ownership (TCO) approach they can reduce operational risk, enhance operational efficiency and drive sustainability.

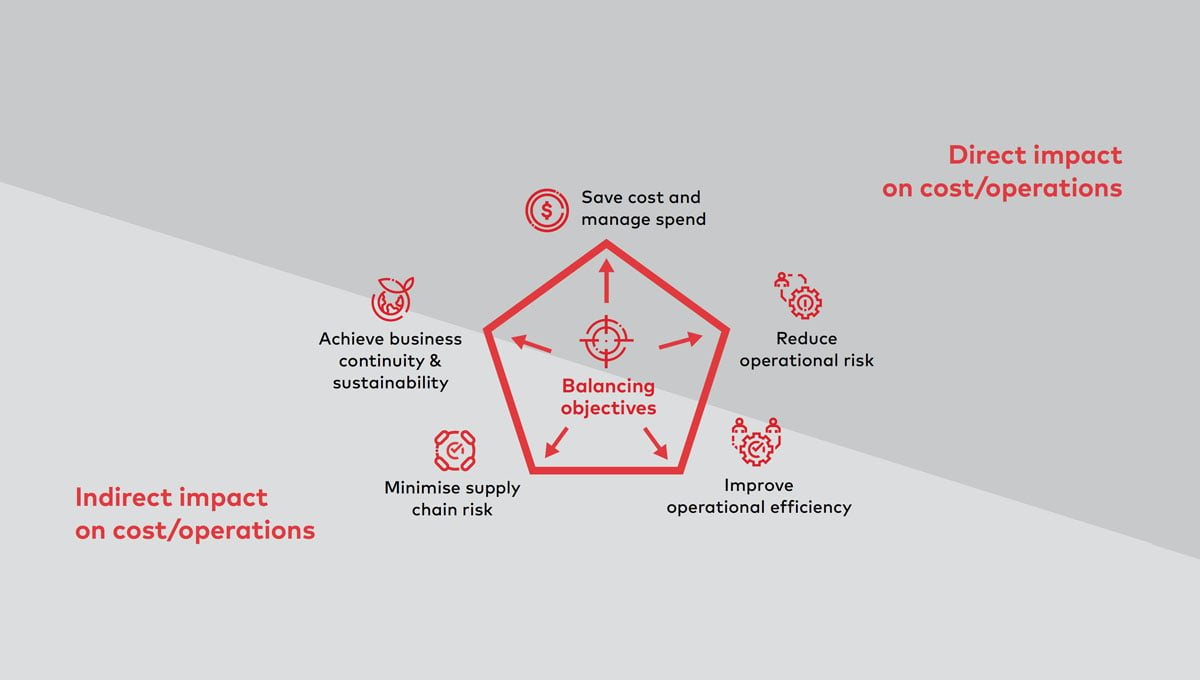

In order for this approach to be successful, however, objectives need to be carefully balanced, with every outsourced scope of work and contractual agreement reviewed by procurement and technical teams to question the norm; better understand risk trade-offs; find better ways of delivery to reduce effort, improve accuracy/quality and ensure stable supply to navigate such challenges. (Figure 1).

Figure 1: Strategic Sourcing Objectives

Not all sourcing challenges are equal!

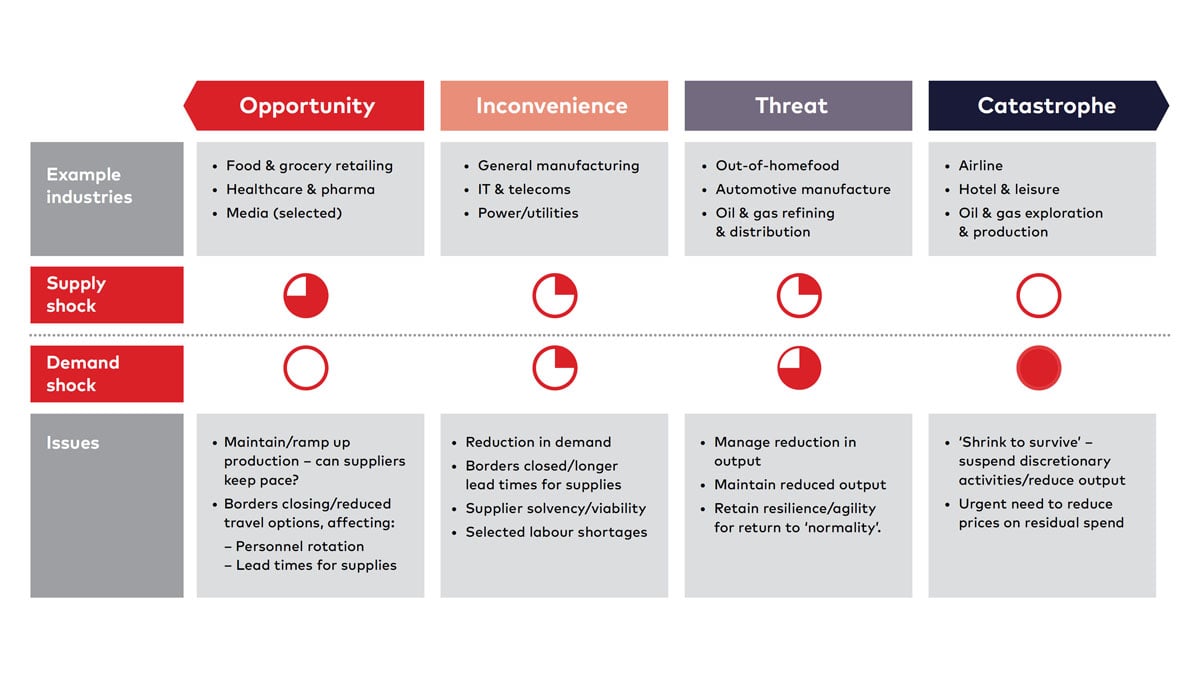

While the above challenges have been observed across multiple industries, supply chain reaction to such COVID-19 shocks has differed. For example, healthcare, pharmaceuticals, and some food & beverage companies have seen an opportunity for growth with high demand, but face challenges of in-time availability of raw materials. On the other end of the spectrum, airlines and oil & gas companies are suffering from low demand for their goods & services and are embarking on rigorous cost optimisation exercises. In particular, COVID-19 has exposed the unreliable sourcing strategies of many organisations (Figure 2).

Figure 2: Supply and demand shocks across multiple industries

It is a situation that highlights four specific pressure points organisations need to consider carefully when it comes to the contract stage:

- Sourcing diversity: Heavy reliance on low-cost countries like China hasn’t helped many global players. A diverse sourcing approach is required to manage supply risks.

- Share the pain: Terms and conditions should deal with disruptions together as strategic partners should benefit all parties rather than contribute to collapse.

- Align with business continuity plans: Planning for and storage of emergency stock to ensure business continuity.

- Be Transparent: The visibility of supply network risks and capacity constraints should be clear

So what’s the starting point and how can companies avoid the pitfalls?

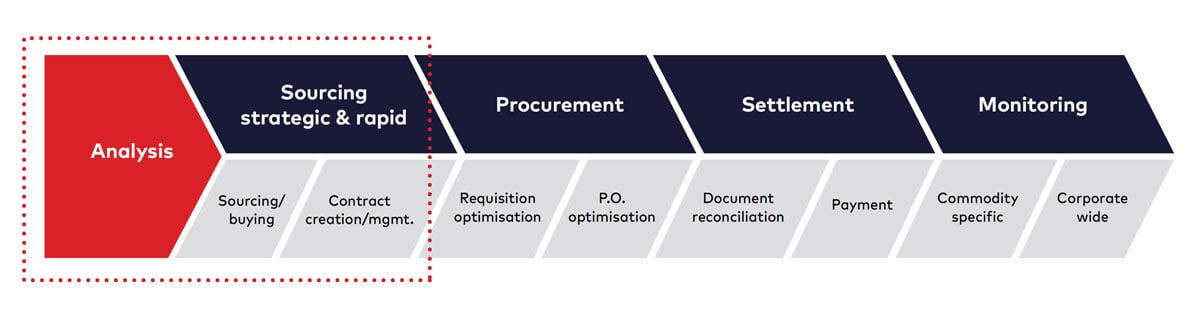

Firstly, the ability of an organisation to respond effectively to external supply/demand disruptions depends heavily on its internal procurement value chain. There are two fundamental pieces of the procurement value chain that represent the starting point of a strong setup: Analysis and Sourcing (Figure 3). It is essential to have a structured, analytical approach to scope identification, spend analytics, supplier and business risk management, and supplier review and selection. Sourcing lays the foundations for effective category and vendor strategies and improved long-term value and contract performance.

Figure 3: Procurement Value Chain

Yet, even though the first procurement function was established in the 1800s and has evolved through several rounds of transformations, organisations continue to face basic sourcing challenges that under-leverage the ability to purchase departments to contribute to an organisation’s competitiveness.

Below are the top four sourcing pitfalls we’ve identified:

- Incorrect understanding of demand and specification needs as well as spending patterns, often resulting in a restricted vendor ecosystem, characterised by higher than necessary costs and bloated working capital.

- Single source situation with no backup, no prequalified product alternatives for key purchases. If the purchasing organisation is not reactive, the organisation will find it hard to quickly address supply issues and negotiate solutions with vendors.

- If process compliance is low, it will lead to high off-contract spending and ineffective demand management measures.

- Contract Management: If contracts don’t include the right triggers e.g. for raw materials, organisations won’t be able to adapt price or volume. If the warehouse management system is not transparent enough organisations won’t be able to make the right arbitrage between reducing their stock levels and business continuity risks

Maximising cost-saving opportunities

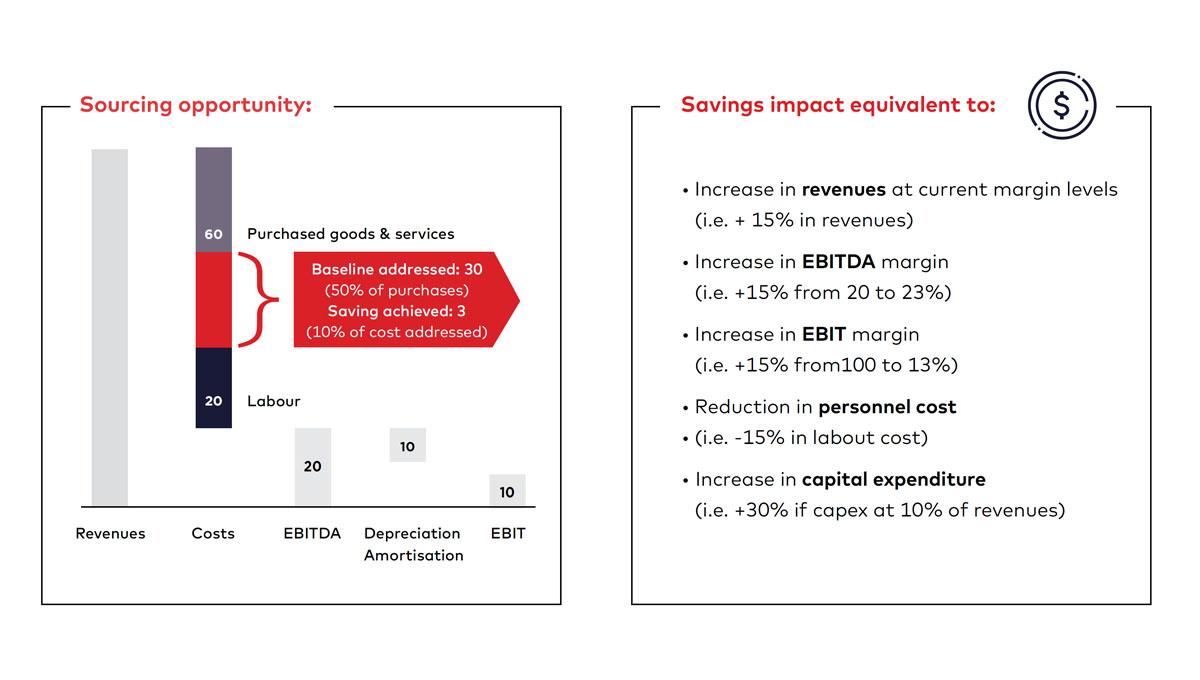

On a more upbeat note, effective sourcing of goods and services represents one of the largest cost-saving opportunities, with rapid measurable impacts on organisations. It is a highly effective tool that reaps benefits over a reasonably short period of time with a comparably low pain level, while also balancing risk-return trade-offs and targeting wider improvements such as a reduction of operational risks, improved operational efficiency, minimised supply chain risks, which can help companies achieve business continuity and sustainability goals. If we take a typical manufacturing environment where purchased goods and services represent 60% of revenues, the impact of a sourcing initiative is equivalent to a 15% reduction in workforce or a 15% increase in revenue, representing an attractive focus for optimisation during a crisis such as COVID-19 (Figure 4).

Figure 4: Potential savings impact from exploring sourcing opportunities (illustrative)

Main pathways to reducing cost

Strategic Sourcing operates best on a number of levels. It’s a highly bespoke, category-specific approach that guarantees a high impact on cost and supply chain risk, while at the same time providing an opportunity to upskill the existing purchasing organisation.

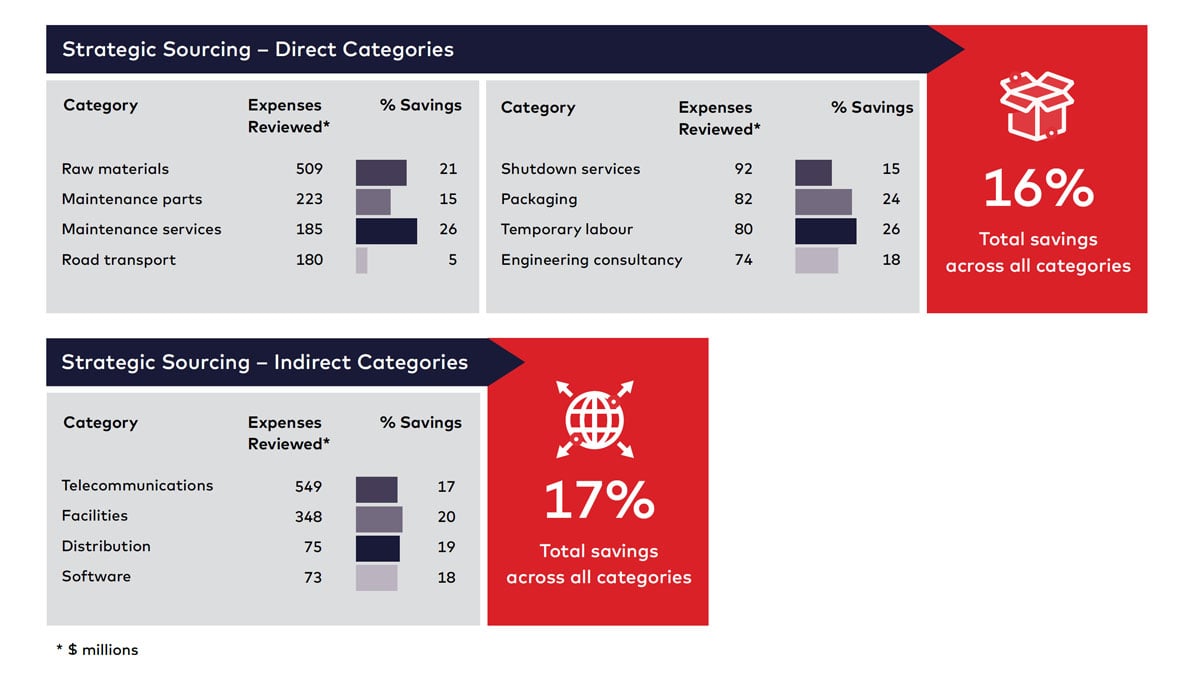

A typical savings objective for Strategic Sourcing would be around 15% to 20% (Figure 5) and sometimes more. However, this will depend on the structure of the supply market and category. For example, Very competitive, low-margin industries like road transport have streamlined process flows with little opportunity to further optimise the cost base. On the other end, highly specialised technical services and goods can yield very significant savings if a competitive situation can be created and demand is re-specified.

A similar savings potential applies to indirect purchasing categories that represent large opportunities, including IT, Telecoms, or Facilities management through the use of sale and leaseback or renegotiated rental agreements

Rapid sourcing takes on smaller categories in parallel through a more standardised approach to cover a broad range of several hundreds of vendors and improve unit prices. It is used to address the remaining categories and vendors at the lower end of the Pareto curve and typically has a lower percentage savings impact due to the nature of the approach. During current times, however, every penny counts, and savings higher than the average of 6% is likely as suppliers show an increased appetite to cultivate and maintain long-term client relationships

Figure 5: Example of Strategic Sourcing cost savings across different categories

Identifying the seven levers that unlock sourcing value and future-proof strategies

Once organisations have focused their initial efforts on addressing the immediate supply network constraints and managing the supply disruptions to re-start operations, business executives need to turn their attention to the medium-term security of the supply base, unlocking working capital intelligently and building future-proofed resilience strategies. This approach will not only help manage the immediate COVID-19 emergency but also build stronger and more resilient businesses ready to thrive as economies return to growth.

Figure 6: Seven savings levers spanning the procurement value chain

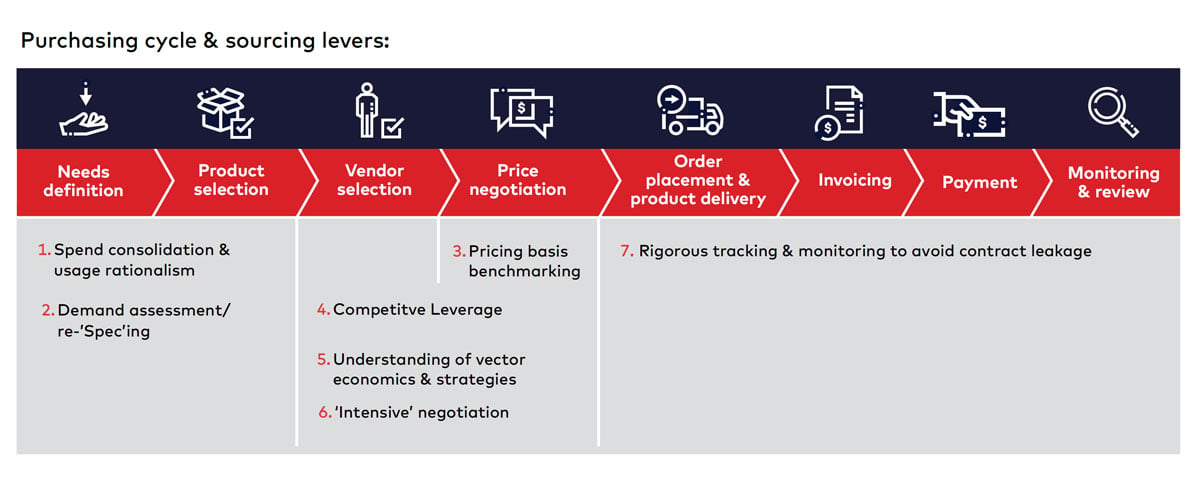

By defining seven key levers used by procurement & technical functions to create transparency, options, and competitive situations companies can build a strong ongoing position to commence the negotiation process (Figure 6).

We have expanded on these levers below:

- Spend Consolidation & Usage Rationalisation: Develop transparent reports to analyse external (outsource) spending to understand high-value vendors, business needs, and contract usage to identify “out of scope” items.

- Demand/Specification Assessment: Consolidate the business needs to understand the demand for goods and services. Re-evaluate the specifications to move away from ‘gold plating’ (utilising product or service specifications higher than industry standard or higher than really required ) and aiming for fit for purpose.

- Pricing Basis Benchmarking: The commercial teams should have a clear understanding of ‘should be cost’ to have a good understanding of cost levers that could be leveraged for negotiation.

- Competitive Leverage: It is often observed that various contractual agreements are heritage and have been continued for years and never been questioned. There should be special emphasis on increasing the number of bidders to increase competition to get the best value for money spent.

- Understanding of Vendor Economics & Strategies: Leverage vendors’ supply chain configurations and conduct benchmarking analysis to figure out the best fit for your organisation

- “Intensive” Negotiation: Negotiation is a skill and should only be carried out by qualified professionals with a clear understanding of risk-value trade-offs and BATNA (the best alternative to a negotiated agreement).

- Rigorous Tracking & Monitoring to avoid contract leakage: Post-contract management is as important as the pre-award stages. Organisations need to allocate specific resources to ensure execution effectiveness and contract performance are monitored to address emerging issues and any contract leakage.

Use guiding principles to achieve success through best practice

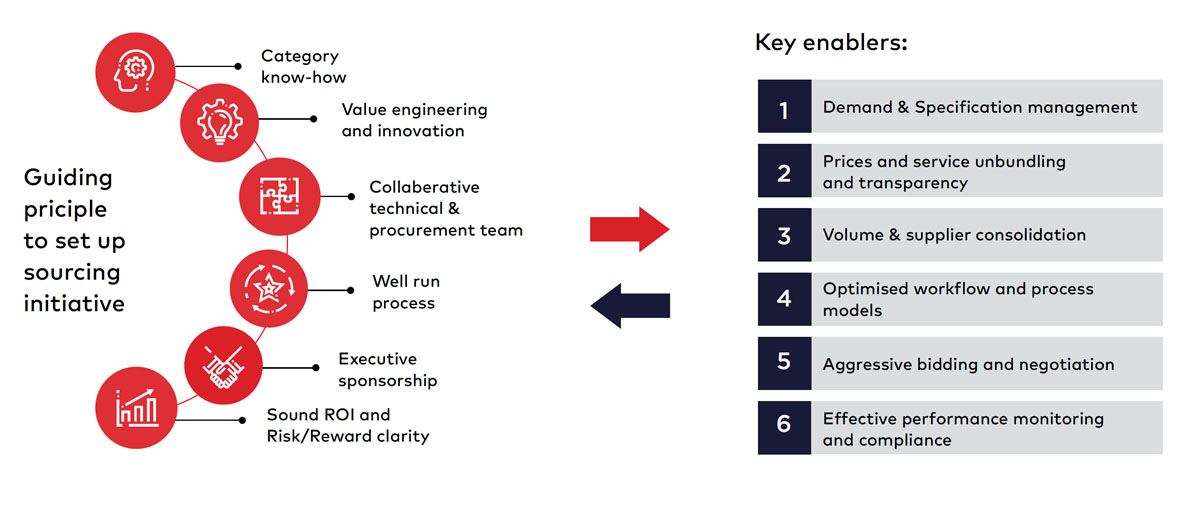

As well as identifying key levers, companies should look to adopt a resilient approach with a well-defined set of guiding principles. These guiding principles help organisations define a best practice approach to maximise the output from initiatives employed (Figure 7).

Figure 7: Guiding principles

- Category Know-How: There are often core purchasing and raw material categories where each organisation has a longstanding intricate knowledge, and then there are areas where contribution to domain knowledge is required. This can be in the form of a vendor list of several hundred suppliers of chemicals products, rate cards for specific products & services, or RFX templates and bid grids.

- Value Engineering and Innovation: Working within the existing specification is often only the second-best solution. So, while casting the net wide, it is essential to include and test product alternatives and consider innovation. Question the current standards and find ‘different ways of working’ to improve operational efficiency, including the use of the new digital tools

- Collaborative Technical and Procurement Team: To effectively innovate and challenge specifications, purchasing needs to be on an equal footing with the technical teams throughout the organisation. Constructive discussions and inter-team dialogues should take place to ensure that evolution in specifications is not only driven by technical or production considerations but also supply chain implications.

- Well-Run Process: A sourcing process involves several internal departments including, R&D, technical, production, logistics, marketing, and numerous vendors. Accordingly strong project management is key to achieving timely results.

- Executive Sponsorship: Sourcing often leads to opportunities, but also to risk/return tradeoffs. Executives' sponsorship, clear accountability, and decision-making are preconditions to harvest and lock in the potential improvement.

- Sound ROI and Risk/Reward clarity: Companies need to define the right scope and sequencing of the initiative upfront to keep the resourcing in line with the opportunity and ensure a healthy return on investment

Next steps

Finally, we know from our Strategic Sourcing panel group that today’s top three objectives are “achieving business continuity” (44%), “reducing costs” (27%), “improving operational efficiency” (19%). We also know that companies with resilient supply chains have the ability to achieve these objectives by taking a holistic approach to Strategic Sourcing - making savings while driving change; managing cost, supply, and operational risk; driving best practice procurement

Nor is the COVID-19 pandemic the only event to threaten business continuity. Disruptions are increasing in frequency and magnitude, and include climate-related disasters and geopolitical events such as Brexit and the US-China trade wars. It’s important, therefore, to build buffers into the supply networks to reduce disruption. Strategic Sourcing offers a way to map out the steps to recover from, and even thrive, amidst the myriad risks that continue to threaten a company’s existence.

As we can see from the case study illustrated overleaf, choosing a partner with the expertise to guide you through these steps will be vital in a company’s ability to navigate the tough challenges ahead in order to achieve and maintain a market-leading position.