The Time Is Now to Go Green

Global consumers are increasingly throwing their buying power behind brands that matter, products that don’t harm the environment, and companies with purposes that align with their own beliefs.

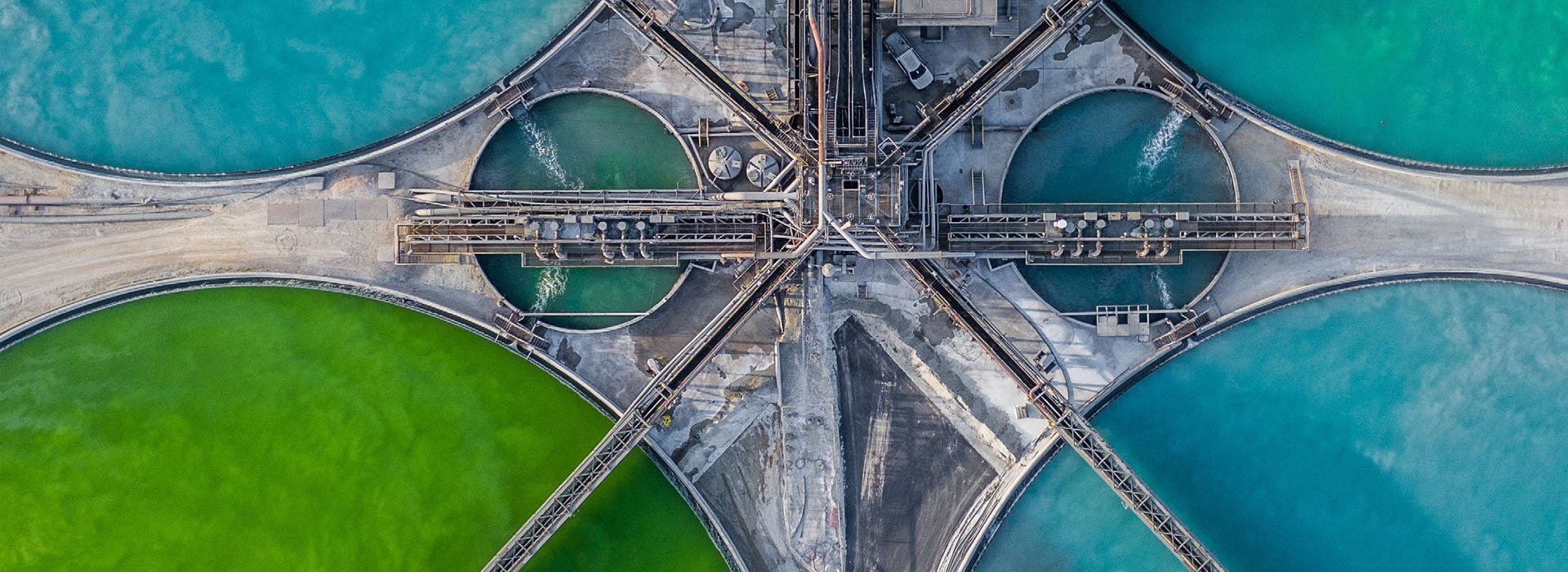

Companies across all industry segments are faced with the fact that outside pressure is requiring them to improve their environmental footprint. New regulations, public opinion as driving forces to act on climate change, the heightened interest of investors as well as consumers looking for products that don’t harm the environment are forcing companies to take a hard look at their operations. As the resounding voice of today’s stakeholders is heard around all industries, calls for more eco-friendly products mean looking at the entire value chain. Companies are quickly realizing that big wins can come from looking holistically at their operations and manufacturing.

The chemical industry, being resource intensive in raw materials and energy use as well as a source of emissions and waste, is the crux of bigger, faster change. While the industry has known for some time that sustainability has to be a friend in business and not a foe, the value paradigm is shifting fast. The sustainability market is where the safety industry was in the 1950s, still very compliance-driven and highly reactive to government norms and pressures.

Now is the time to anticipate future trends, clarify business strategies on how to get there, and partner with the game changers who can innovate to embrace the realities of a circular economy. Chemical companies are finding new partners; sourcing alternative raw materials; delving into process optimization; and reducing energy consumption, waste and emissions, all while optimizing their supply chain. They know there is a real opportunity to help customers meet their sustainability goals, but it’s going to mean taking a long, hard look at their own operations, investing in their existing assets, and adding innovative new technologies and processes.

It’s clear. The time is now to go green - or just go.

Sustainability on many levels has to evolve faster than ever before and the chemical makers are the start of the value chain.

Here are five things chemical companies need to start doing right now to stay in the game:

- Take their place in the circular economy.

- Look for new ways to source renewably and recycle.

- Step up their ESG game.

- Begin the process of the energy transition.

- Adapt the organisational capabilities to enable cultural transformation.

1. Circular economy

Companies view the transition to a circular economy as a positive one, as the process provides access to new markets, boosts profits, and improves competitiveness and brand recognition. The approach seeks to use natural resources safely and responsibly while eliminating waste. Most new companies are circular by design, but established brands may need a mindset shift to continue to compete or to be relevant in new markets.

Solugen, a 5-year-old chemical company, bills itself as the first carbon-negative molecule factory that can scale to meet the world’s needs. They combine enzymatic transformation with chemical catalysis to make chemicals without significant waste streams or by-products.

For example, Solugen uses glucaric acid to combat scaling and boost the cleaning power of automatic dishwasher detergents. Preliminary life-cycle analysis suggests the process is carbon negative overall. “We want to make sure the carbon footprint associated with our chemistry is as low as possible,” says Jun Su An, product development director for Solugen. “We also want to make sure that we have the most nontoxic, most biodegradable chemistry.”1

Established companies like Nouryon, a spin-off of AkzoNobel, which has been producing hydrogen peroxide using the conventional method for over 75 years, evaluated the economics of Solugen’s new process. They found it compares well to the traditional method, mainly because it yields two valuable products from one simple raw material. Solugen and Nouryon have since formed a joint venture to partner and perfect the process even further.

Partnerships in circularity can shed light on possible secondary markets, upcycling, repurposing, and revealing hidden value. In addition, these partnerships almost always facilitate access to design, raw materials, or processes that would be costly to build or create from scratch without the partnership. New partnerships equal new collaborations and a new way to innovate.

Now is the time to break down in-house silos and fill talent gaps to embark on a true business model and mindset shift that meets both company and consumer demands for growth and change. Chemical companies that can seek out natural sources of raw materials with minimal environmental impact—while also increasing safety for producers and consumers alike—are already ahead of the game.

2. Source renewably and recycle

Chemical companies are uniquely positioned to reuse, regain, and repurpose raw materials. More and more, consumers are willing to pay a premium for goods made from renewable or recycled ingredients. This allows for additional value extraction when the process is streamlined and even more when the resources are renewably sourced from the beginning.

Solutions within an organization’s immediate control can be found in the reduction of nonrecyclable materials and alternative sourcing opportunities, as well as in investing in modern recycling technologies. Action cannot come too soon.

A good example is BMW. They were one of the first automakers to commit to a 1.5-degree reduction in climate change by 2030. The EU’s new Directive on End-of-Life Vehicles (ELV) is changing everything about cars, from conceptualization to how they are built. Andreas Vetter, BMW’s project lead for exterior and interior design, notes that his job is to totally re-envision the entire vehicle life cycle from design and production to manufacturing and end of life, to see Source renewably and recycle if the vehicle’s parts can be made as durable with renewable sources.

“That means more recycled metals, more plant-based fibers, and using just one type of synthetic material versus a range of them for each part,” Vetter said. “Instead of making components from scratch, we have to find ways to make everything with a lower environmental footprint that can be easily recycled when its useful life has ended.”

A big area for reduction will be in thermoplastics. That’s where the chemical industry comes into play. BMW says it will replace 40 per cent of thermoplastics with recycled materials by 2030. Chemical manufacturers have been working with plant-based polymers for some time. Some researchers have been able to create green thermoplastics that perform just as well as, if not better than, several key commodity polymers. Thermoplastic innovations based on renewable feedstocks are bringing sustainability to the automotive industry as well as to other industries that rely on unique polymers for the safety and strength of their products.2

The American Chemistry Council (ACC) points out that as circularity grows in importance, those in the plastics and polymer composites industry will need to work together – and with part suppliers and automakers – to help the automotive industry transition fully toward a circular economy. In a recent report, the ACC noted that circularity presents a potential $4.5 trillion business opportunity by 2030 – and roughly $400 billion to $600 billion could go to automotive companies and their suppliers, helping fuel more innovations to make vehicles more sustainable.3

Biocomponents and innovations in plastics are positioned to become one of the overarching solutions for the automotive industry. The Mercedes-Benz E-Class has 72 parts made from recycled plastic. The “remanufacturing of components and the use of recycled materials…ensure that today on average about a third of the materials that are used to build a car comes from secondary sources,” according to Daimler.

Several major OEMs have even partnered with various entities to establish “vehicle recovery networks,” or closed-loop recycling operations for the recovery of automotive parts once they reach the end of life. Automakers like Ford, BMW, and Renault have set up free take-back networks that accept end-of-life vehicles from owners around the world, providing a valuable pipeline for recycling polymer-based materials.

Braskem, the world’s leading biopolymers producer, manufactures green polyethylene from sugarcane ethanol. As the largest producer of thermoplastic resins in the Americas and the largest producer of polypropylene in the United States, Braskem has invested in the development of I’m green™ products, sourced from renewable sources and recycled content. Braskem’s bioplastic has a negative carbon footprint, and the company also committed to 100 per cent of plastic packaging being reused, recycled, or recovered by 2040. Their goal is to create products that help clients meet aggressive recycled content goals in the next several years and to achieve carbon neutrality for themselves by 2050.

Geoffrey Inch, Braskem’s circular economy & sustainability director for North America, says that innovations in plastics are widely recognized as playing a crucial role in delivering a more sustainable future. “Along with innovation, our Circular Economy Strategy will continue to aggressively progress projects in mechanical and advanced molecular recycling, and we are working with our recycling partners to address the issue of plastic waste as well,” Inch adds.

Braskem is a founding member of the Alliance to End Plastic Waste; a member of Operation Clean Sweep® blue; and a founding member and founding partner of the Polypropylene Recycling Coalition, an initiative of The Recycling Partnership with a focus on increasing U.S. curbside recycling access for polypropylene (PP) and ensuring PP is widely recovered and reused in end markets such as food and beverage packaging, consumer products, and automotive.4

As they build multi-company coalitions and multi-industry ecosystems, chemical companies are now the first step in the circular economy. Chemical companies are pooling resources, expertise, and research to develop new solutions to pressing issues. They are collaborating with customers to anticipate their needs, global trends, and how to navigate individual country regulations.

3. Environmental, social, & governance (ESG)

Climate change; investor, citizen, and consumer interest; and increasing regulation are putting pressure on companies globally to deliver environmental, social, & governance (ESG) and sustainability practices that operate seamlessly throughout the organization.

ESG today is about core aspects of your business and your authenticity as a brand. It has to be baked in. It can’t be an afterthought or a nice thing you do any longer. Customers are too savvy. It has to be who you ARE.

For chemical companies, determining their “true north” was usually an in-house huddle. Now it’s clear that outside collaborations and industry partnerships are helping many to move past just mitigating shared risk to really creating sustainable ecosystems and thereby expanding access to new markets and consumers.

To show how chemistry enables sustainable growth, BASF set a “Value to Society” metric as their first step toward measuring what is real to customers and society as a whole. Their goal is a pragmatic and auditable approach that accounts for positive contributions to social and economic value creation.

BASF has been reporting on this value since 2013 and notes that the “driving positive factors are taxes paid, wages, social benefits, employee training, and net income. Negative contributions result from environmental impacts such as CO2 emissions, land use and emissions to air, soil and water, as well as health and safety incidents.” They contend that by measuring and reporting transparently on their business activities, a company’s stakeholders can understand the significance of both financial and non-financial impacts on society. All contribute to a company’s long-term success.5

Chemours has touted its commitment to being a vanguard of responsible chemistry since it separated from DuPont and recently took a bold step toward an even more ambitious climate goal. In their journey to net-zero operations by 2050, Chemours just declared a 60 per cent absolute reduction of scope 1 and scope 2 greenhouse gas (GHG) emissions by 2030.6 They plan to achieve this through a comprehensive plan that includes emissions control technologies, energy efficiency improvements, and increasing energy use from renewable sources.

Recognizing that the time to act is now, Chemours is taking bold steps toward transparency and quality reporting when it comes to its ESG strategy and goals. Recently, when they set out to design and build their new mining project in Jesup, Georgia, they did so with respect for the planet and local wildlife in mind. They use cutting-edge mobile mining units to extract essential minerals with precision—minimizing the impact on wildlife, surrounding wetlands, and aquifers—before returning the sites to their pre-mining condition. These machines have no engine noise, lower dust levels than traditional methods, and are safer for Chemours employees. The company even goes so far as to hold 39 million gallons of water in above-ground treatment ponds to make sure that there is no threat to the local water supply and recycles 98 per cent of the water used in the process.7

With an extensive network of more than 12,000 suppliers spanning over 70 countries, the Chemours supplier network is seen as an extension of the company. In 2020, the company asked suppliers to become a part of the Supplier Corporate Responsibility Assessment (SCRA) and nearly 60 per cent of their supply chain is now participating, which is helping Chemours make progress toward one of its key goals.8

A sustainable supplier base that serves the interest of all involved is part of the holistic approach Chemours is taking, looking both inward by setting reach footprint reduction goals, and outward up and down the value chain to understand their overall impact and make progress where they can.8

This demonstrates again that key partnerships can help organizations unlock the maximum value from an ESG strategy through an integrated management approach, leveraging operational excellence and operational risk management to protect, transform, and sustain business impact.

4. Transition to renewable energy

Companies taking part in the energy transition are viewed as responsible and are thought to provide more value in terms of customer loyalty, talent attraction, ability to manage risk, higher price-to earnings ratios, higher market values, and lower cost of capital.

The transition is a monumental undertaking and a complex equation that has yet to be solved. One of the biggest challenges facing chemical manufacturers in implementing net-zero strategies related to energy is the balance between short- versus long-term objectives. In the short term, meeting shareholder objectives in contribution margins are going to be important. At the same time, investing in renewable energy strategies now to meet the medium- to long-term expectations of customers and regulatory agencies is also critical.

Covestro, a manufacturer of high-quality polymer materials and their components, recently set an ambitious target of net zero emissions by 2035 for scope 1 and scope 2 with a 60 per cent reduction in greenhouse emissions by 2030. They went even further to pledge that every product will be offered in a climate-neutral version in the future with many key products already offered as such today.

To reach this bold target, Covestro will have to look up and down its value chain. Production processes will need to be improved further and energy efficiency enhanced to achieve even more sustainable manufacturing. Covestro has said that its production sites worldwide will be gradually converted to renewable electricity. Converting steam generation from fossil to renewable energy sources is a challenge that they intend to solve by various routes.

They anticipate dedicated capital investments of “an accumulated EUR 250 million to EUR 600 million by 2030, resulting in lower operating expenses of expected EUR 50 million to 100 million annually due to growing energy efficiency.”9 There’s no question that spending on physical assets for the net-zero transition is going to be a substantial scale-up relative to the past. It means capital will have to be spent very differently than it is today, focused specifically on the deployment of new physical assets and the decarbonization of existing assets that are cheaper to use. Further, managing risk/return tradeoffs and addressing the uncertainty of technological investment will need to be effectively managed.9

Integrating safety and sustainability into process design actually contributes to improved margins rather than simply increased costs. The challenge for most chemical companies will be the initial investment and the time frame to see large returns. But once it is embedded into daily operations, like safety and efficiencies, then production losses and waste are greatly reduced. In safety, for every dollar invested, typically there is a $7 to $10 return. Sustainability data is still limited, but the return could be even higher as waste and energy reduction significantly cut operating costs.

Even though the realization of net-zero still seems like it’s in the distant future, most agree that companies need to start planning for it now. Getting there will mean a complete and fundamental transformation of the world’s economy. Let’s be clear: With all the economic and political challenges, no one will get to the finish line alone. But for each business, there are steps in the right direction—big and small—that can help companies get and stay ahead of the curve.

5. Organisational capabilities to enable Cultural transformation

Consumers are going to continue to drive the circular economy and demand ESG plans and proof that the companies they buy from are walking the walk. As chemical manufacturers double down on their environmental commitment, reset perceptions, and continue to build trust, they can strengthen their role in product innovation and provide new solutions to complex upstream and downstream sustainability challenges.

Chemical makers can create real value, whether through extracting energy efficiencies, creating new revenue streams from production waste, or gaining a competitive edge with the product or business model redesigns. Responding to the ever-changing regulations for various countries and anticipating trends, chemical companies have the in-house technical expertise and industry knowledge to capitalize on the latest opportunities, enabling growth up and down the value chain.

Investors are seeking to understand their ESG risks and opportunities and to set clear criteria for their investments, while companies are embedding sustainability performance and decarbonization into their corporate strategy and operations across their value chains.

The business will need to adapt its organisational and operating model to integrate sustainability across all processes, systems and workforce skills. The world is looking for businesses to deliver all aspects of ESG. But innovation is not enough. Whole systems will need to change. Now is the time to engage your employees, empower your teams, identify your partners, and get to work.

Here are the key steps companies can take to look beyond their own boundaries and build cooperation and collaboration along the value chain and with external partners.

- Form government-industry sustainability workgroups to ideate approaches to embed sustainability into daily business operations. Look at what the government’s role should be (beyond setting static regulations and providing financing, grants, expertise, tax breaks, etc.), as well as the role that industry and sustainability workgroups should play to shape the future.

- Create industry forums where chemical companies and sustainability experts debate and then develop practical sustainability implementation approaches for the shop floor and across the industry value chain.

- Increase public and social awareness of the industry challenges. For instance, we all use plastics and we can’t just get rid of them overnight. A circular economy is complex with multiple stakeholders. Bring communities into the dialogue. They will be key to recycling, using less energy, and influencing buying habits.

The time is now.

References:

- “The cleaning industry seems serious about sustainability,” Feb. 13, 2022, Chemical & Engineering News. https://cen.acs.org/environment/ sustainability/cleaningindustry-seems-serious-sustainability/100/i6

- “Recycling Your Car: Why European Automakers Are Building Sustainable Vehicles,” Dec. 13, 2021, Forbes. https://bit.ly/3rbVvoZ

- Braskem Press Release - https://www.prnewswire.com/news-releases/braskem-affirms-commitment-to-circular-economy-and-to-achievecarbon- neutrality-by-2050-301169170.html

- BASF Website - https://www.basf.com/global/en/who-we-are/sustainability/we-drive-sustainable-solutions/quantifying-sustainability/valueto- society.html

- Chemours Website - https://www.chemours.com/en/corporate-responsibility/2030-goals

- Chemours 2020 Corporate Responsibility Commitment Index Report - https://bit.ly/3LTyPUg

- Chemours Website - https://www.chemours.com/en/corporate-responsibility/2030-goals/evolved-portfolio/sustainable-supply-chain

- Covestro Press Release - https://www.covestro.com/press/covestro-aims-forclimate-neutrality/