Investment in LATAM Renewable Energy: Accelerating value creation through operational risk management

dss+ Private Equity Discourse Series

Continued momentum among investments in LATAM renewable energy assets, partnered with increasing expectations for performance, will drive the need for a prioritisation of near-term operational risk mitigation in the quest for long-term value creation.

In 2022, while the Private Equity (PE) industry in North America reported muted returns overall and found fewer opportunities for lucrative exits, PE funds targeting renewable energy amassed ~$294 billion in dry powder, $127 billion of which sits with funds targeting Latin America (LATAM region) energy and cleantech investments.1

Between 2021 and 2022, the region saw 53 deals worth ~$10.6 billion comprised of PE investments in utilities (split between power generation, transmission & distribution) across Brazil, Chile, and Colombia.1

“.. average holding period on portfolio has lengthened, driving the need for proactive value creation opportunities.”

– LATAM Clean-Tech Fund

PE investment in LATAM renewable energy is anticipated to gain further momentum as firms deploy significant dry powder and Limited Partners (LPs) look to increase their exposure to the recession-resistant industry. Key drivers include net-zero commitments (2050), energy diversification towards solar and wind driven by decarbonisation, and favourable government policies and subsidies.

“.. ESG diligence is a priority for PE investors as they pivot their capital allocations to renewables.”

– M&A Advisor (legal) to LATAM PE Funds

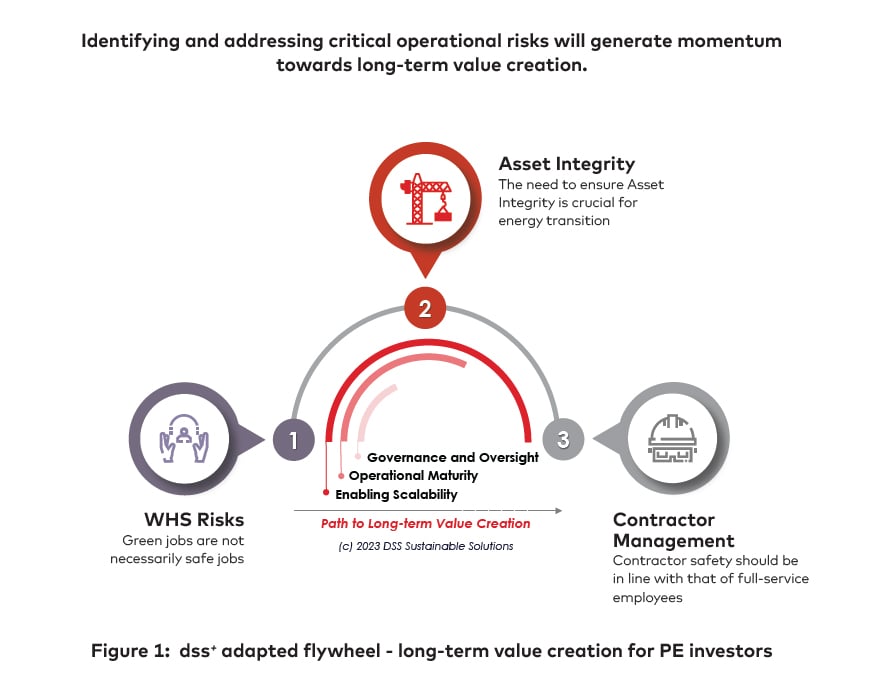

Although promising, LATAM’s renewable energy sector has a relatively low-maturity operating environment due to lack of rigour, experience, and capacity to adequately address and manage risks and opportunities. dss+ has identified three critical areas (Figure 1) that PE investors should consider in their pursuit of sustainable, long-term value creation.

The flywheel effect encompasses small wins in operations/business that in aggregate and with time, build on each other to gain momentum and perpetuate growth.

Prioritising critical operational issues such as worker health and safety and asset integrity will lay the foundation for broader interventions to drive sustainable operations, which in turn will enable long-term value creation.

PE investors looking to catalyse long-term value creation should first identify and address operational risks and opportunities in the areas of worker health and safety (WHS), environmental, and asset integrity.

1. WHS Risks

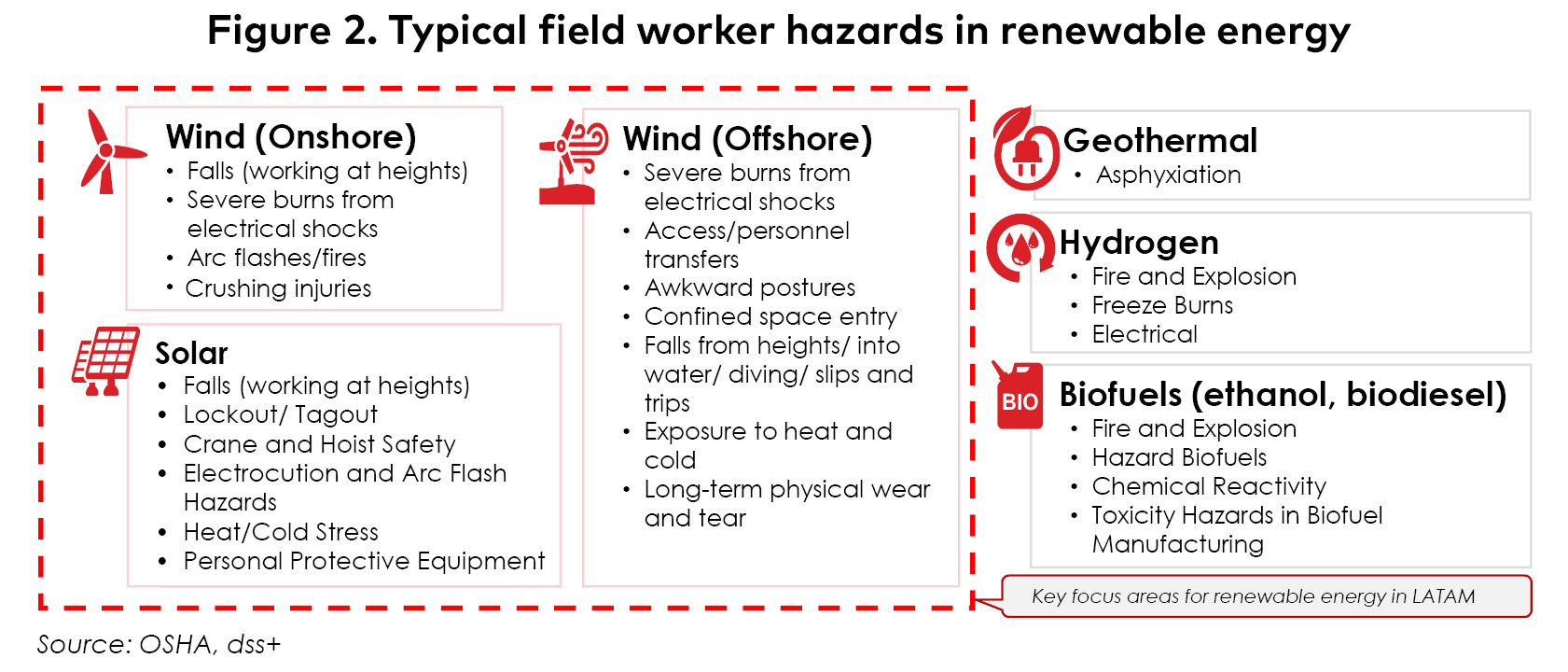

dss+ has identified several critical safety risks (Figure 2) for renewable energy field workers. In addition to typical WHS hazards; such as those from electrical contact, man-machine interaction, road traffic, civil works, and extreme weather, renewable energy jobs require specialised operations that may expose untrained field workers to risks that could lead to serious injury or fatality. Contributing factors include risks associated with natural conditions, such as vehicle transit over irregular terrain and working in remote locations to install power generation/transmission lines, as well as challenges in attracting and retaining qualified workers.

“Utilities are learning about the WHS risks from solar and wind power… still early days in the energy transition journey.”

– Solar Power Utility in Colombia

Operators are recommended to identify competency gaps, improve employee risk awareness, and strengthen leadership skills to align with desired practices by measuring the ongoing effectiveness of safety management systems and routines.

2. Asset Integrity

The reliability of critical equipment and safety systems to support renewable energy production and transmission in LATAM has been compromised by aging infrastructure and a lack of data to quantify the potential gaps in process safety. Compounding factors include uneven geological stability, a lack of public security, and frequently outdated engineering and technology. Additionally, limited connectivity to remote locations challenge access to the parts and people needed to address asset integrity and reliability.

“Transmission and distribution infrastructure continues to remain outdated and inaccessible, leading to frequent renewable energy curtailment.”

– Solar Power Generator and Distributor in Chile

Renewable generation operators may consider applying Asset Integrity and Quality Assurance supported by Maintenance and Reliability Management at all stages of the asset life cycle, from design to decommissioning, in order to sustain risk mitigation and prevent catastrophic failure of critical renewable energy assets.

Once operational risk mitigation measures are implemented, PE investors can address immediate interventions in the form of contractor safety management, enabling rapid scalability and effective business partner identification.

“Renewable energy Engineering, Procurement, and Construction (EPCs) in LATAM are usually awarded to foreign contractors that hire local subcontractors for project execution … worker safety is often overlooked, creating a risk for human life.”

– Renewable Power EPC Contractor

3. Contractor Management

A lack of trained manpower and challenges in attracting and maintaining skilled labour have necessitated a higher dependency on contracted labour in the LATAM renewable energy market. Additional pressure on contractors is evident through rising ESG rating expectations and the need for renewable power operators to provide transparency on performance issues.

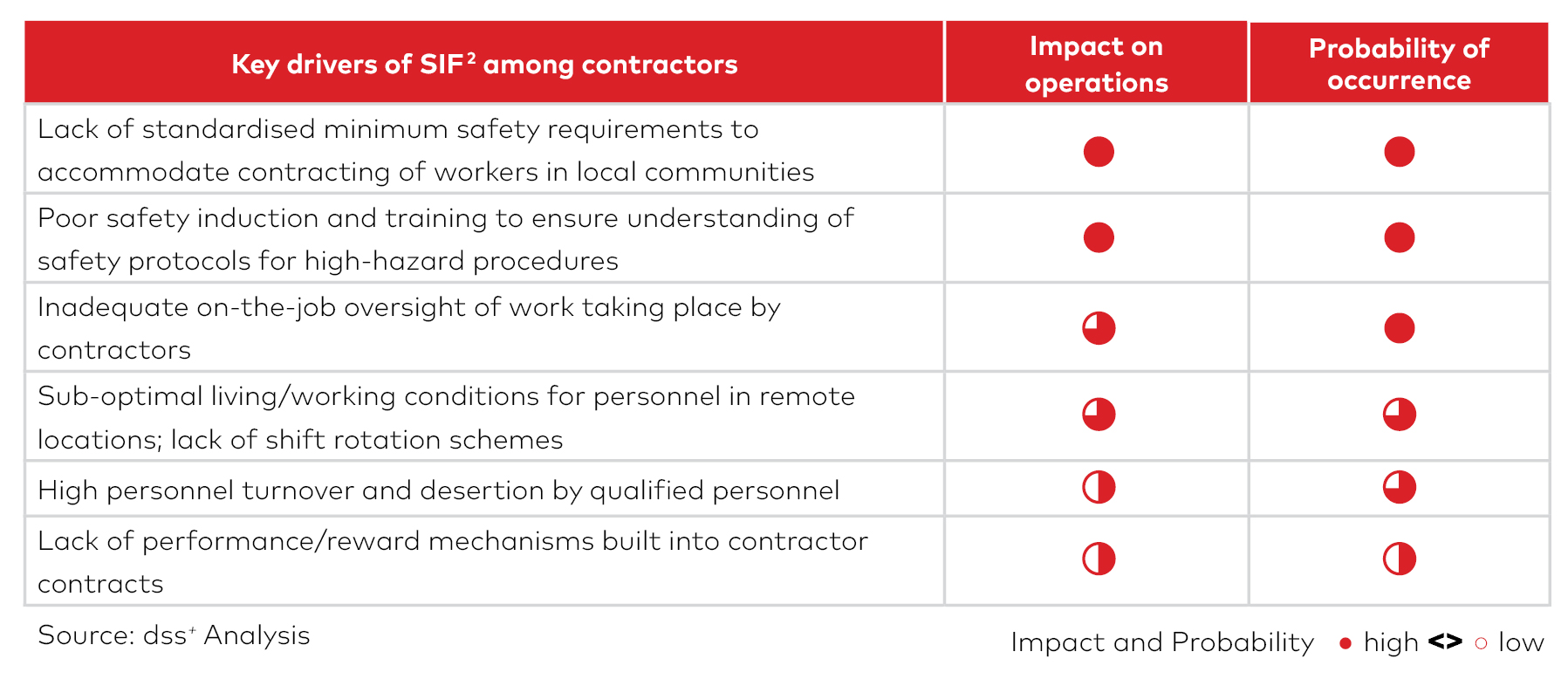

Operators conducting solar installations and windmill replacements, for example, see an acute need for training and support of inexperienced service providers to ensure awareness and understanding among workers, so that basic safety measures will be met when performing core activities. Typical drivers of worker fatalities resulting from sub-par contractor management are listed in the table below.

Industry-leading practice suggests to identify, evaluate, and incorporate worker health and safety into the job specifications for contractors, supported by robust training and job site induction, and proactive performance monitoring.

Following the adoption of measures to effectively mange or influence the management of contractors, PE investors can leverage interventions to further optimise performance, mitigate risks associated with regulatory compliance and legal frameworks, and strengthen alliances with regional and local partners.

In tandem with the transition to net zero in LATAM, PE investor expectations for renewable energy operators are gaining momentum. Increasing scrutiny from governments, investors, and consumers on how operators conduct business is reflected in growing demand for in-depth risk assessments, disclosures of non-financial KPIs, and impact metrics. Accelerating PE investors’ ability to address long-term value creation, risks, and opportunities, dss+ recommended actions are captured in the table below.

Industry best practice also suggests that organisations effectively identify and assess environmental, land, and human rights issues in operations (including contractors) and across the supply chain of renewable energy companies. Operators should have strategies, policies, and procedures in place, along with competencies to perform solid assessments of current and planned future operations.

These topics, and others, will be explored in future articles in this series.

Why dss+?

- dss+ approach to due diligence enables firms to accurately assess the relationship between a target’s risk exposure AND risk management, unlocking key opportunities for value creation that are missed when deal teams focus on risk exposure alone, or don’t effectively assess and weight the level and quality of management

- dss+ approach to improvement planning and implementation ensures the value creation potential of effective risk management is optimally captured, measured, and communicated within the holding period

- dss+ industry and functional expertise can be leveraged to define the point of maximum value capture, so that the full financial impacts of improvement plans are realized ahead of exit

SOURCES:

- Source: dss+ research and proprietary data from PitchBook.com screened on February 08, 2023

- Serious Injury and Fatality (SIF)

- Examples: Colombia’s Superintendencia Financiera de Colombia (SFC) introduced the Green Taxonomy; Brazil’s SEC revised the Resolution 59; Chile’s Financial Market Commission (CMF) updated the Rule 461

Authors

Contributors