Why CEOs should take an integrated risk-based approach?

Success with safety, sustainability and operational transformation today requires allocating resources and applying preventive measures equal to the risks involved. Importantly, it's an approach that avoids the consequence of inappropriate de-risking behaviour that can limit an organisation's ability to capture opportunities and futureproof operations fully.

Why CEOs should take an integrated risk-based approach for success in safety, sustainability and operational transformation

Traditionally, risk is viewed through a single lens. Whether it’s anticipating the risk profile scenario for process safety, preventing work-related injuries, falling short of sustainability targets, or not transforming operations to meet production demands, overcoming this silo mentality to risk management and fostering integration with core asset and operations management is increasingly essential.

To get the best from operations and capture new opportunities, organisations must move from managing risks and opportunities independently to managing interdependencies across the entire organisational ecosystem. So what are the main benefits of taking an integrated risk-based approach to safety, sustainability and operational transformation and what are the issues driving the agenda forward?

"To get the best from operations and capture new opportunities, organisations must move from managing risks and opportunities independently to managing interdependencies across the entire organisational ecosystem."

– Sebastien Planche, EMEA Director Industries & Practices, dss+

Capture opportunities to accelerate growth

Increasingly businesses are becoming more connected internally and externally. Technological advancements allow businesses to expand and grow efficiently and more rapidly. Yet as more companies replicate mega-projects involving thousands of employees and contractors in new territories, the demand for skilled labour and pressures on the supply chain now need additional consideration. How will a lack of experienced labour impact operational excellence targets and safety incidents? How can organisations accelerate growth and capture new opportunities in an environment with scarce resources? The maturity of suppliers, particularly in the safety, process efficiency, and environmental impact chain, is a further consideration. For example, can contractors match your sustainability performance standards? If not, how will this impact the project’s ability to deliver? Taking a more holistic approach to how risks and opportunities are interconnected and interdependent allows organisations to get the best from the entire supply chain whilst optimising costs to reinforce competitive advantage. Equally, an integrated-risk approach helps give CEOs the 360° view they need to capture opportunities and accelerate global growth more effectively.

"An integrated-risk approach helps give CEOs the 360° view they need to capture opportunities and accelerate global growth more effectively."

– Sebastien Planche, EMEA Director Industries & Practices, dss+

Strengthen sustainability and transformation strategies

As sustainability issues gain traction and mature, they will increasingly link every aspect of an organisation. Environmental, social and governance (ESG) will become vital components of an organisation’s operational risk profile. Alongside a global raft of environmental legislation needing consideration to reduce carbon footprints and improve resource efficiency, organisations also have a social responsibility to ensure that they adhere to best practices regarding how employees are treated and trained globally. The need for organisations to become more socially responsible creates additional risk pressure points. Notably, recent global health and geo-political events have resulted in a lack of skilled labour in a broad range of industry sectors. This is now considered a significant risk to achieving business production and performance expectations, particularly in the food sector and power & utilities industry. As a result, the need to train more staff to meet high operational and safety standards and enhance leadership skills requires organisations to reassess their growth ambitions, development processes and timeframes to meet these additional demands. Assessing sustainability’s wider reach across the organisation can help transformation plans evolve and succeed.

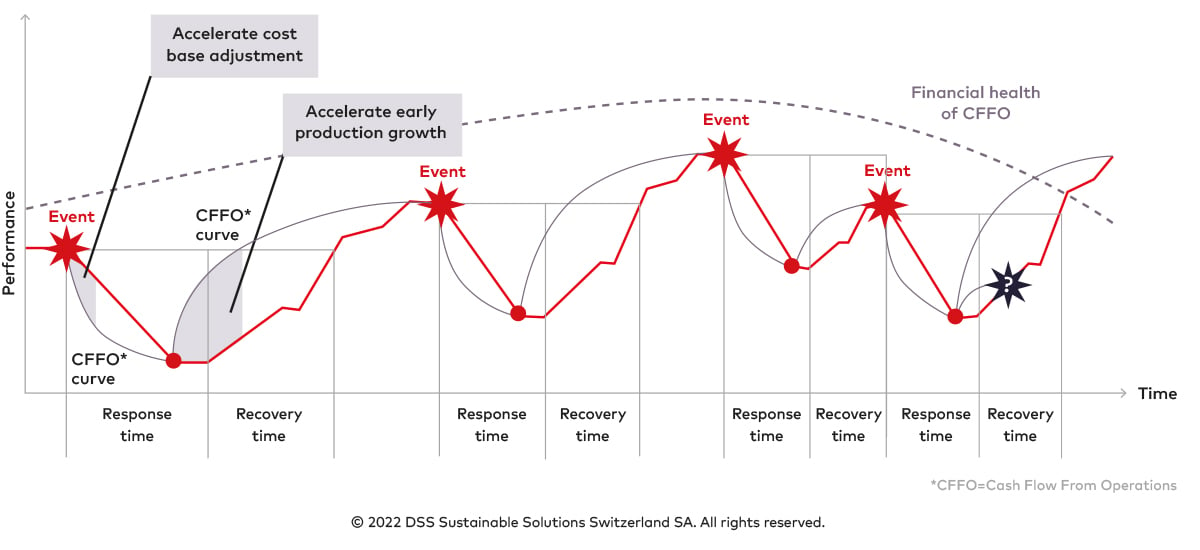

Foster agility and resilience

Assessing business risk interconnections, interdependencies and where risk gaps exist is only part of the story. For many organisations implementing an integrated risk-based approach that is agile enough to cope with a rapid change in events (see figure 1) is not straightforward, particularly when the majority of risks and opportunities are contained in the supply chain and outside an organisation’s immediate control. However, implementing policies that encourage an integrated risk-based culture, even on a smaller scale, can drip-feed through and impact your external ecosystem to improve your overall risk profile exponentially. Focusing on top risks to drive cost-effective transformation and spend management efforts on what matters most can improve the agility required to accelerate the shift towards net zero carbon emission and resource utilisation optimisation across an organisation’s ecosystem.

Figure 1: Frequency of critical events, influencing organisational operations (illustrative).

Futureproof risk management strategies

Sector-specific influences and economic conditions often influence how organisations manage risks and opportunities. However, recent unexpected events, such as the pandemic and the current energy crisis, mean global health and rising geo-political issues that threaten energy security present additional considerations to take on board. The scarcity and price volatility of raw materials impact an organisation’s ability to operate and threaten sustainable strategies and safety agendas as rising costs curtail budgets. Nor can carbon footprints be reduced without considering your customer or the impact on operations and safety processes; the risks involved are interconnected. The resilience to drive performance forward in the face of such a turbulent landscape now requires companies to accurately capture risk interdependencies between safety, operations and sustainability to help futureproof risk management strategies.

"By fostering integration with core asset and operations management, CEOs can drive the organisational transformation and growth needed to futureproof operations and unlock their full performance potential."

– Sebastien Planche, EMEA Director Industries & Practices, dss+

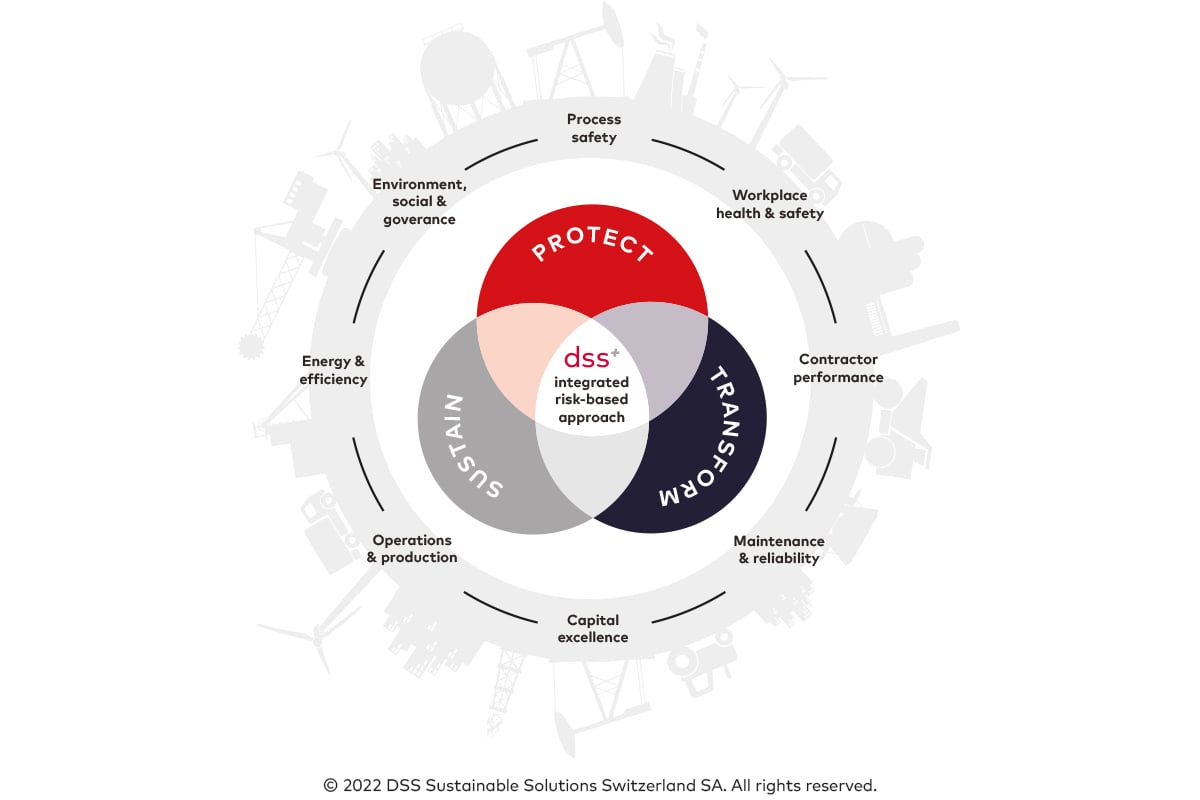

dss+ integrated risk-based approach

When considering an integrated risk-based approach, organisations already have some experience to guide them. A level of risk maturity brought about by legislation that encourages companies to look at risk through the lens of safety operations is already in place. What is new is the overwhelming range, complexity and speed of events organisations now face. There is also the burning platform of sustainability where risk maturity is less developed, yet a growing stakeholder requirement.

Looking ahead, adopting effective governance to overcome risk management silos and strengthen opportunities will become increasingly vital. By fostering integration with core asset and operations management, CEOs can drive the organisational transformation and growth needed to futureproof operations and unlock their full performance potential. Importantly, taking an integrated risk-based approach will involve moving from a compliance focus to creating the agility and right corporate culture to adapt to evolving business cycles and accelerate the much-needed transition to more sustainable business operations.

Also available in:

Contact the author