Be smart about Climate Risk

Climate risk is no longer a distant concern – it’s a material business risk. For executive teams, the challenge is not recognising the issue but determining how to cut through the noise and identify where it truly affects operations, assets, and long-term growth. Too often, climate risk assessments feel abstract, lack clear next steps, and leave leadership guessing.

Extreme weather events are already disrupting operations, insurance markets are tightening, and regulatory pressure is moving faster than many businesses anticipated. At the same time, climate models are becoming far more precise, revealing exposures that were invisible even a few years ago. Companies that rely on broad, qualitative assessments increasingly find themselves surprised by asset degradation, unplanned downtime and escalating recovery costs. Boards and investors are now asking harder questions: not just whether climate risk is understood, but whether it has been quantified in a way that guides capital allocation and operational planning.

This article offers a practical, stepwise approach to do exactly that. It provides a defensible calculation of financial exposure across assets and operations, translating physical hazards into a clear Value at Risk (VAR) framework. It shows where climate-driven failures are most likely, how severe they could be and which interventions reduce exposure at the lowest cost. Instead of treating climate adaptation as an open-ended problem, this approach narrows decisions to the actions that matter most and gives leadership a clear basis for prioritisation, investment and accountability.

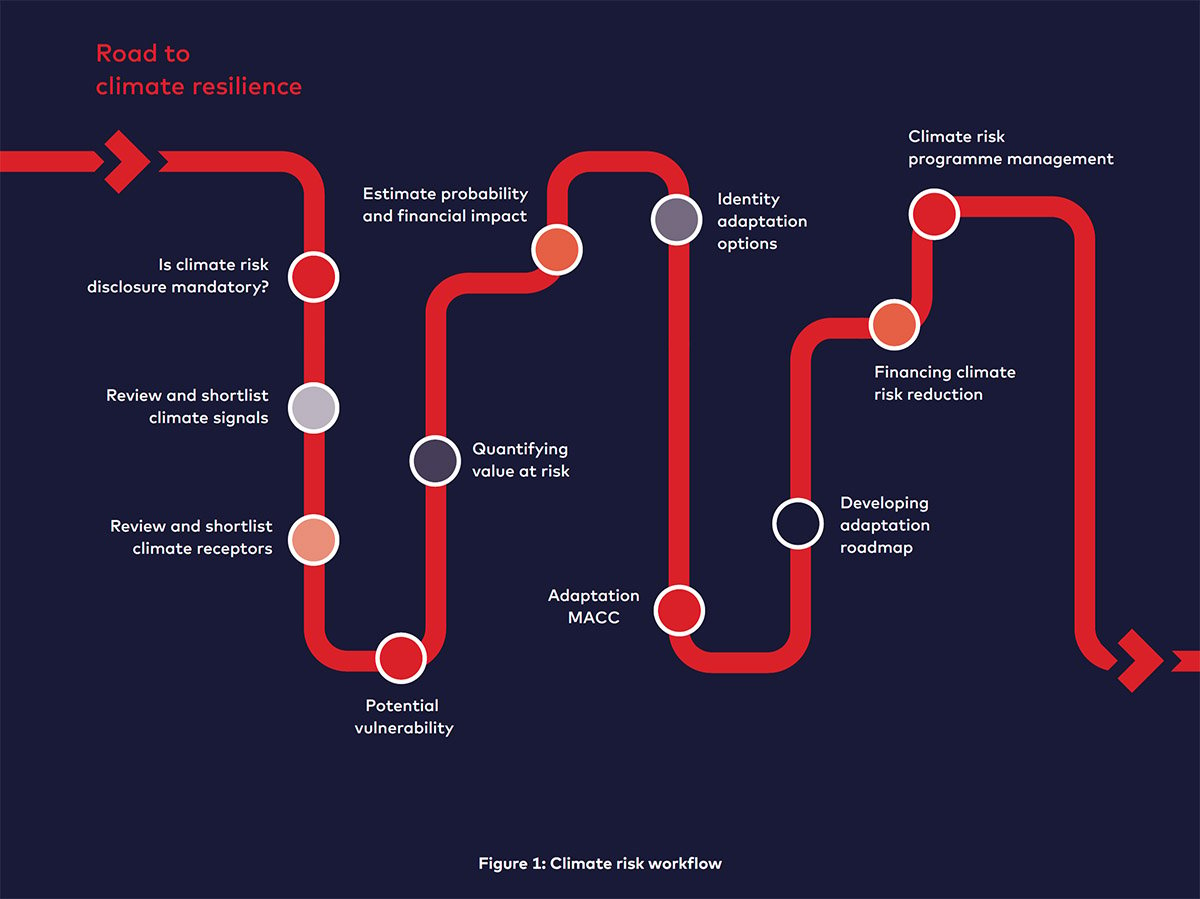

Climate change should not be relegated to a low-value sustainability topic; it is a strategic risk that can be managed with the same rigour and economic discipline as any other. The framework removes subjectivity and guesswork, giving you clarity and confidence to act, and consists of three distinct phases: calculating VAR, prioritising adaptation measures, and operationalising chosen risk reduction actions. The phases and underlying steps are designed so that a decision can be made at each stage on whether it makes sense to progress to the next.

This workflow lays out a clear progression: begin with foundational requirements, build a defensible view of risk, then prioritise and operationalise the most cost-effective actions.

Step 0 – Assess organisational maturity

Evaluate where the organisation stands on the Bradley Curve to understand current climate-risk maturity and identify gaps in governance, culture and capabilities.

Step 1 – Review and shortlist climate hazards

Identify the climate signals (e.g., heat, precipitation, flooding, wind, drought) expected to change over time using historical data and scenario modelling.

Step 2 – Review and shortlist receptors

Determine which systems, assets and value-chain components could be impacted by those hazards, using site documents, industry scans and targeted system deep-dives.

Step 3 – Identify potential vulnerabilities

Combine hazards and receptors into a vulnerability matrix to highlight where climate impacts could cause infrastructure damage, production losses, maintenance issues or safety risks.

Step 4 – Quantify Value at Risk (VAR)

Develop damage functions to convert vulnerabilities into financial impacts under different climate scenarios, producing a quantified VAR for each hotspot.

Step 5 – Estimate probability and financial impact

Use a 5×5 risk matrix to combine probability and severity, revealing the most significant exposures. Include how climate intensifies existing Serious Injury and Fatality (SIF) risks.

Step 6 – Identify adaptation options

Create a full portfolio of adaptation measures—structural, nature-based, policy and behavioural—ranging from quick wins to major infrastructure upgrades.

Step 7 – Develop the Marginal Adaptation Cost Curve (MACC)

Rank all adaptation options by cost-effectiveness, comparing the cost of each measure with the amount of VAR it reduces.

Step 8 – Build the adaptation roadmap

Translate analysis into a practical, prioritised roadmap that integrates technical feasibility, cost, organisational readiness and alignment with business processes.

Step 9 – Finance climate-risk reduction

Determine the right financing pathway—self-funding through capital allocation or accessing climate finance instruments such as grants, concessional loans or resilience bonds.

Step 10 – Manage climate risk as a programme

Embed climate risk management into continuous improvement, strengthening governance, capabilities, monitoring systems and automation to reassess risk regularly.

Conclusion

Climate risk is no longer an abstract sustainability issue – it is a material business risk that demands structured, data-driven action. The ten-step framework outlined here transforms uncertainty into clarity by quantifying Value at Risk (VAR), prioritising adaptation measures, and embedding resilience into core business processes. From identifying climate signals and receptors to developing damage functions, estimating financial exposure and ranking interventions through a Marginal Adaptation Cost Curve, this approach ensures decisions are grounded in both science and economics.

Critically, the roadmap integrates adaptation into corporate strategy, governance, and financing mechanisms, enabling organisations to act within operational and capital constraints while leveraging external climate finance opportunities. By institutionalising continuous improvement and automation, companies can maintain momentum, reassess risks efficiently and align with evolving climate models and regulatory requirements.

This is not just about compliance – it is about safeguarding assets, operations and growth in a changing climate. Organisations that adopt this structured approach will not only reduce risk but also unlock competitive advantage through resilience, cost efficiency and stakeholder confidence.

Download the full article here to explore the complete methodology and its practical implications for your organisation.

Author

Co-author